Korean stock market worse than South America...Enforcement of financial investment tax? Postponed? Abolished? [Y Record]

■ Host: Anchor Kim Youngsoo Kim, Anchor Kim Jung-jin

■ Starring: Son Seok-woo, Economic Critic

* The text below may differ from the actual broadcast content, so please check the broadcast for more accurate information. Please specify [YTN Newswide] when quoting.

◇Anchor> We have looked at the impact of interest rate cuts on the real estate market. Now, it will affect the financial market, especially in the case of the stock market, interest rate cuts are a good thing. Recently, however, there has been an active discussion on financial investment income tax among political issues. How do experts see this as a matter of interest as to whether the gold tax will be implemented or suspended in January next year?

◆Son Seok-woo> This week, the Democratic Party of Korea held a general meeting of lawmakers to decide on the party's theory on this financial investment. However, in the end, the general meeting of the lawmakers failed to reach a conclusion. So I decided to delegate it to the leadership. As you know, the Democratic Party of Korea is actually at the key to implementing the financial investment tax in January next year, but it is the majority party.

However, even among lawmakers, there were heated debates over whether to keep the plan in place, suspend it, or abolish it altogether and create a new round, and opinions were so tight that they could not vote for or against it.

So we eventually made the decision to delegate it to the leadership, and there are reasons for each, whether it's implementation, deferment or abolition. This is a situation where the market continues to be uncertain, and in the end, the Democratic Party leadership has to come to a conclusion.

◇ Anchor> However, the Korean stock market has a very low growth rate compared to the global stock market this year alone. On the contrary, there are many stocks that have fallen.

◆Son Seok-woo> The rate of increase is lower than that of South American countries.

◇ Anchor> But if you suspend or abolish the gold investment tax now, do you think it will have a positive impact on the stock market? What do you think?

◆Son Seok-woo> Determining the stock price is very complex. We also reflect economic fundamentals, but we cannot rush to judge whether this will go up or down with just the financial investment tax because the overall internal and external economic conditions at that time work in combination.

However, given this premise, it is clear that the uncertainty related to the financial investment tax has clearly been a negative factor for the stock price. For example, if the political circles make such hard-line remarks and the financial investment trend, the index immediately turns to the downside or increases the fall.

In terms of supply and demand, the overall stock trading volume has decreased a lot as uncertainty related to the gold investment tax has emerged as a major topic in our stock market. In particular, individual investors left our KOSPI and KOSDAQ and moved to the US and other countries' stock markets.

Looking at the overall flow of these things, it can be seen as the aftermath of uncertainty about the financial investment tax, and a number of surveys have recently been conducted on the general public and experts regarding the financial investment tax. The overall result was that many opinions against the introduction of the financial investment tax prevailed.

So, if the introduction of the financial investment tax is suspended or abolished, investors may be less worried about tax in the short term. In the short term, this sense of relief that policy uncertainty has disappeared is likely to serve as a boon.

◇Anchor> I see.

Excerpted from

: Lee Sun Digital News Team Editor

#YRecord

※ 'Your report becomes news'

[Kakao Talk] YTN Search and Add Channel

[Phone] 02-398-8585

[Mail] social@ytn.co.kr

■ Starring: Son Seok-woo, Economic Critic

◇Anchor> We have looked at the impact of interest rate cuts on the real estate market. Now, it will affect the financial market, especially in the case of the stock market, interest rate cuts are a good thing. Recently, however, there has been an active discussion on financial investment income tax among political issues. How do experts see this as a matter of interest as to whether the gold tax will be implemented or suspended in January next year?

◆Son Seok-woo> This week, the Democratic Party of Korea held a general meeting of lawmakers to decide on the party's theory on this financial investment. However, in the end, the general meeting of the lawmakers failed to reach a conclusion. So I decided to delegate it to the leadership. As you know, the Democratic Party of Korea is actually at the key to implementing the financial investment tax in January next year, but it is the majority party.

However, even among lawmakers, there were heated debates over whether to keep the plan in place, suspend it, or abolish it altogether and create a new round, and opinions were so tight that they could not vote for or against it.

So we eventually made the decision to delegate it to the leadership, and there are reasons for each, whether it's implementation, deferment or abolition. This is a situation where the market continues to be uncertain, and in the end, the Democratic Party leadership has to come to a conclusion.

◇ Anchor> However, the Korean stock market has a very low growth rate compared to the global stock market this year alone. On the contrary, there are many stocks that have fallen.

◆Son Seok-woo> The rate of increase is lower than that of South American countries.

◇ Anchor> But if you suspend or abolish the gold investment tax now, do you think it will have a positive impact on the stock market? What do you think?

◆Son Seok-woo> Determining the stock price is very complex. We also reflect economic fundamentals, but we cannot rush to judge whether this will go up or down with just the financial investment tax because the overall internal and external economic conditions at that time work in combination.

However, given this premise, it is clear that the uncertainty related to the financial investment tax has clearly been a negative factor for the stock price. For example, if the political circles make such hard-line remarks and the financial investment trend, the index immediately turns to the downside or increases the fall.

In terms of supply and demand, the overall stock trading volume has decreased a lot as uncertainty related to the gold investment tax has emerged as a major topic in our stock market. In particular, individual investors left our KOSPI and KOSDAQ and moved to the US and other countries' stock markets.

Looking at the overall flow of these things, it can be seen as the aftermath of uncertainty about the financial investment tax, and a number of surveys have recently been conducted on the general public and experts regarding the financial investment tax. The overall result was that many opinions against the introduction of the financial investment tax prevailed.

So, if the introduction of the financial investment tax is suspended or abolished, investors may be less worried about tax in the short term. In the short term, this sense of relief that policy uncertainty has disappeared is likely to serve as a boon.

◇Anchor> I see.

Excerpted from

: Lee Sun Digital News Team Editor

#YRecord

[Kakao Talk] YTN Search and Add Channel

[Phone] 02-398-8585

[Mail] social@ytn.co.kr

[Copyright holder (c) YTN Unauthorized reproduction, redistribution and use of AI data prohibited]

Editor's Recomended News

AD

The Lastest News

-

재생

Lebanon/Gaza air strikes simultaneously...Hezbollah's successor lost contact

Lebanon/Gaza air strikes simultaneously...Hezbollah's successor lost contact -

The five-year increase in the number of inmates assaulting correctional facilities...190 cases last year

-

재생

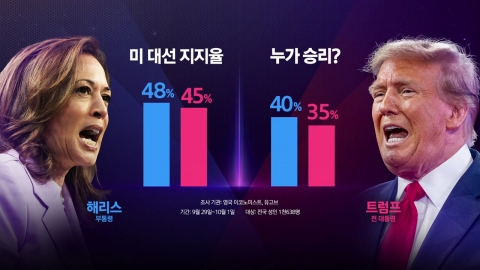

D-30 U.S. Presidential Election, Harris and Trump, All-in-one to target the concentration center of the original forces.

D-30 U.S. Presidential Election, Harris and Trump, All-in-one to target the concentration center of the original forces. -

Rescue of 4 people on boats and rafts on the Han River

![[29th Bu-guk]](https://image.ytn.co.kr/general/jpg/2024/1005/202410051409548508_h.jpg)

![[29th Deputy International] Director Yeon Sang-ho,](https://image.ytn.co.kr/general/jpg/2024/1005/202410051044435284_h.jpg)