-

이혜훈 폭언 녹취 공개…유승민 ’총리 러브콜’ 인정재생

- 지방선거의 해…민주 "개혁" 국민의힘 "민생"

- 민주, 긴급 최고위 소집…윤리감찰단 보고받을 듯

- 국민의힘 "강선우 탈당은 면피용 꼼수…불법 공천 철저 수사"

-

강선우 탈당·김병기 감찰…"끊어낼 건 끊어내야"재생

-

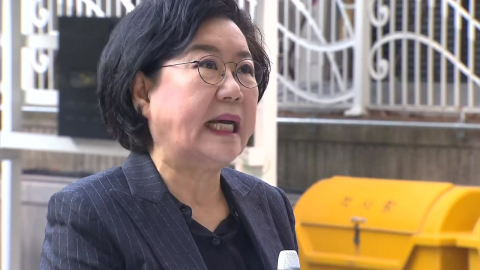

1억 원 공천 헌금 의혹으로 수사를 받는 강선우 의원이 민주당을 탈당했습니다. 김병기 전 원내대표도 당 윤리감찰단에 회부됐는데, 정청래 대표는 성역이나 예외는 없고, 끊어낼 건 끊어내야 한다고 말했습니다. 취재기자 연결합니다, 조은지 기자! 탈당 소식부터 전해주시죠? [앵커] 네, 지난 2022년 지방선거 과정에서 공천 헌금 1억 원을 수수했다는 의혹을 받는 강선우 민주당 의원이 탈당 뜻을 밝혔습니다. 강 의원은 자신의 SNS에 이미 당과 당원 여러분께 너무나도 많은 부담을 드렸고 더 이상은 드릴 수 없다면서 다시 한 번 고개 숙여 사죄드린다고 적었습니다. 이어 당을 떠나더라도 당이 요구하는 모든 절차에 성실히 임하고, 수사에도 적극 협조하겠다고 전했습니다. 강 의원은 어젯밤에도, 그동안 어떤 돈도 받은 적 없다면서 의혹을 강하게 부인해 왔지만, 경찰 수사가 본격화하고 비판 여론도 커지면서 새해 첫날 선택에 나선 것으로 보입니다. 금품수수 방조, 묵인 의혹을 받는 김병기 의원도 원내대표직을 사퇴한 데 이어, 당 감찰을 받는 사실이 오늘 확인됐습니다. 정청래 대표는 기자들과 만나 김병기 의원의 각종 ’갑질·특혜 의혹’에 대해 지난달 25일 이미 당 윤리감찰단에 조사를 지시했다고 뒤늦게 공개했습니다. 당 핵심 관계자들은 YTN에 당시 현직 원내대표 신분임을 고려해 감찰지시 사실을 공개하지 않았다고 설명했고요, 당시엔 1억 원 의혹이 드러나기 전이었지만, 현재 감찰 중인 만큼 이 역시 대상이며, 현재는 당사자를 조사하기 전 실무조사가 진행되고 있다고 설명했습니다. 관련한 정청래 대표의 발언, 들어보시죠. [정청래 / 더불어민주당 대표 : 강선우 의원 포함해서 어느 누구도 예외일 수 없고, 성역일 수 없다… 끊어낼 것은 끊어내고 이어갈 것은 이어가겠습니다.] 민주당은 오늘 저녁 8시, 국회에서 긴급 최고위원회를 연다고 공지했는데요, 김병기와 강선우, 두 의원에 대한 윤리감찰단 내용을 보고 받을 것으로 보입니다. [앵커] 김병기 의원에 대해서도 공천 헌금 논란이 불거졌다고요? [기자] 네, 민주당을 탈당한 이수진 전 의원의 과거 발언이 재조명되고 있습니다. 동작을 의원이던 이 전 의원은 지난 2024년 2월 라디오 인터뷰에서, 동작갑 선거 출마를 준비했던 인사 2명에게 ’김병기 의원에게 돈을 줬다가 되돌려 받았다’는 얘기를 들었다고 깜짝 폭로했습니다. 판사 출신인 본인은 정치자금법 위반이라고 봤고, 동작을 현역 의원으로 전체 선거에 미칠 악영향을 고려해 당에 알렸다고 설명했는데요. 이수진 당시 의원은 이들이 쓴 진술서를 당시 이재명 당 대표실에 전달했는데, 진술서가 의혹 당사자인 김병기 의원에게 그대로 전달됐고, 자신은 총선 때 컷오프 당했다고 주장했습니다. [이수진 / 더불어민주당 전 의원 (CBS 라디오, 2024년 2월) : 두 분이 진술서를 써왔어요, (김병기 의원한테) 돈을 줬다, 물론 6개월 후인가에 돌려받았지만 돈을 줬다…] 공관위 간사였던 김병기 의원은 당시 자신의 SNS에 개가 짖어도 기차는 간다는 글을 올려 의혹을 부인했는데요. 당시 금품을 제공한 이들이 썼던 과거 탄원서가 다시 공개되는 등 의혹이 어디까지 번질지 겉잡을 수 없는 분위기입니다. 지금까지 정치부에서 YTN 조은지입니다. ※ ’당신의 제보가 뉴스가 됩니다’ [카카오톡] YTN 검색해 채널 추가 [전화] 02-398-8585 [메일] social@ytn.co.kr

-

새해부터 빨라지는 ’법원의 시간’…보름 뒤 첫 선고재생

-

특검 수사가 종료되며 새해부턴 법정으로 시선이 쏠립니다. 윤석열·김건희 부부 재판은 모두 11건에 달하는데, 보름 뒤 첫 선고가 나오는 사건도 있습니다. 우종훈 기자의 보도입니다. [기자] 윤석열·김건희 부부를 정점으로 하는 특검 수사는 끝났고 이제는 법원의 시간입니다. 특검이 윤 전 대통령 부부를 기소한 건 모두 11건입니다. 이 가운데 1심 선고기일이 잡힌 재판도 있습니다. 공수처 체포를 방해하고, 계엄 국무회의에서 국무위원 심의권을 침해한 혐의 등으로 윤 전 대통령은 16일 첫 선고를 앞두고 있습니다. 특검은 윤 전 대통령이 반성은커녕 하급자에게 책임을 떠넘긴다며 결심에서 징역 10년을 구형했습니다. 윤 전 대통령은 혐의를 부인하며 이렇게 말하기도 했습니다. [윤석열 / 전 대통령 (지난달 26일) : 집으로 돌아가겠다는 생각, 거의 안 하고 있습니다. 제 아내도 구속돼 있고, 제가 뭘 집에 가서 뭐하겠습니까.] 아내 김건희 씨는 도이치모터스 주가조작 혐의 등으로 기소돼 28일 법원 판단을 받는데, 특검은 징역 15년을 선고해달라고 요청했습니다. 이외에도 윤 전 대통령 내란 우두머리 혐의 재판은 9일 변론종결을 목표로 잡았고, 영부인 지위를 활용해 명품 목걸이와 금 거북이, 고가의 그림을 받은 혐의로 기소된 김 씨 재판들도 줄줄이 이어질 예정입니다. 내란 혐의를 받는 한덕수 전 국무총리는 21일, 통일교 정치자금 수수 의혹으로 기소된 국민의힘 권성동 의원은 28일 법원 판단을 받습니다. 특검법이 1심 사건 선고 기한을 6개월, 2·3심은 3개월로 규정한 만큼 새해부터 법정의 시계는 빠르게 흘러갈 전망입니다. YTN 우종훈입니다. 영상편집 : 임종문 그래픽 : 임샛별 ※ ’당신의 제보가 뉴스가 됩니다’ [카카오톡] YTN 검색해 채널 추가 [전화] 02-398-8585 [메일] social@ytn.co.kr