-

민주 "공천 헌금 녹취에 멘털 붕괴"…국힘 '당게' 내홍 고조재생

- 경찰, 강선우 '1억 수수 의혹' 서울경찰청 배당…김병기 사건도 차례로 이송

- 흐느끼는 강선우·단호한 김병기…대화가 녹음된 이유는? [앵커리포트]

- "'멍청한' 당무감사"‥"정치로 풀어야" [앵커리포트]

-

[현장영상+] "역대 정부 최초…내년부터 47개 모든 부처 정책 생중계"재생

![[현장영상+] "역대 정부 최초…내년부터 47개 모든 부처 정책 생중계"](https://image.ytn.co.kr/general/jpg/2025/1231/202512311508108440_h.jpg)

-

새 정부의 주요 국정 운영 과정이 KTV 등을 통해 생중계되고 있는 가운데, 청와대가 이를 확대하는 내용의 브리핑을 합니다. 현장으로 가보겠습니다. [이규연 / 청와대 홍보소통수석] 지금부터 12월 31일 언론브리핑을 시작하겠습니다. 이규연 홍보소통수석입니다. 이재명 정부는 지난 7개월간 국무회의, 업무보고 등 대통령의 국정운영을 생중계했으며 그 영상을 국민과 언론에 전면 개방했습니다. 내년 1월부터는 청와대뿐만 아니라 47개 모든 부처를 대상으로 정책 생중계를 확대합니다. 이 역시 역대 정부 최초입니다. 국무총리와 각 부처가 시행하는 행사 중 정책적으로 중요한 현안이나 국민이 관심을 가질 만한 사안에 대해서는 모두 생중계할 방침입니다. 이를 위해 국민방송 KTV가 촬영, 중계, 송출, 영상 제공을 원스톱으로 지원합니다. 정부 부처의 생중계 영상 역시 언론을 포함한 모든 국민에게 개방합니다. 상징적인 국가 행사는 물론, 다양한 정책 현안도 생중계를 통해 신속하게 국민들에게 알릴 방침입니다. 부처 행사는 규모와 성격에 따라 KTV 국민방송 또는 KTV 유튜브 채널을 통해 송출됩니다. 이번 정책 생중계 확대를 통해 국정운영의 투명성은 더욱 강화되고 정책 신뢰도 역시 높아질 것으로 기대합니다. 개방하면 할수록 국정이 더 투명해진다는 대통령의 국정철학을 과감하게 실천해 열린 정부, 생중계 정부를 실현해 나가겠습니다. 이상입니다. ※ '당신의 제보가 뉴스가 됩니다' [카카오톡] YTN 검색해 채널 추가 [전화] 02-398-8585 [메일] social@ytn.co.kr

실시간 이슈

에디터 추천뉴스

-

재생

![[날씨] 서울 해넘이 시각 임박, 이 시각 남산](https://image.ytn.co.kr/general/jpg/2025/1231/202512311638224389_h.jpg) [날씨] 서울 해넘이 시각 임박, 이 시각 남산

[날씨] 서울 해넘이 시각 임박, 이 시각 남산 -

재생

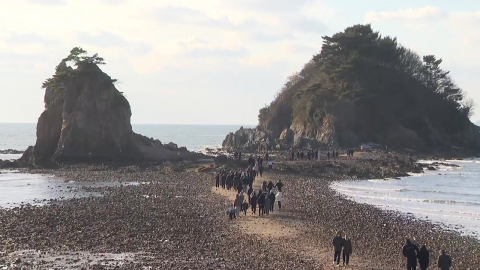

2025년 마지막 해넘이…이 시각 태안 꽃지해수욕장

2025년 마지막 해넘이…이 시각 태안 꽃지해수욕장 -

재생

동해안 해맞이 차량 몰린다…도로공사, 특별교통대책 시행

동해안 해맞이 차량 몰린다…도로공사, 특별교통대책 시행 -

재생

고환율 영향 덮친 소비자물가…넉 달째 2%대 상승

고환율 영향 덮친 소비자물가…넉 달째 2%대 상승 -

재생

!["현상금 500만 원"…대전서 '얼굴 불탄 길고양'이 잇따라 [앵커리포트]](https://image.ytn.co.kr/general/jpg/2025/1231/202512311453461392_h.jpg) "현상금 500만 원"…대전서 '얼굴 불탄 길고양'이 잇따라 [앵커리포트]

"현상금 500만 원"…대전서 '얼굴 불탄 길고양'이 잇따라 [앵커리포트] -

재생

!["나라 바꾼 수홍 아빠" 친족상도례 드디어 폐지 [앵커리포트]](https://image.ytn.co.kr/general/jpg/2025/1231/202512311426059502_h.jpg) "나라 바꾼 수홍 아빠" 친족상도례 드디어 폐지 [앵커리포트]

"나라 바꾼 수홍 아빠" 친족상도례 드디어 폐지 [앵커리포트] -

재생

![추억의 '경찰과 도둑'…"30대부터는 안 돼요" [앵커리포트]](https://image.ytn.co.kr/general/jpg/2025/1231/202512311428476848_h.jpg) 추억의 '경찰과 도둑'…"30대부터는 안 돼요" [앵커리포트]

추억의 '경찰과 도둑'…"30대부터는 안 돼요" [앵커리포트] -

재생

!["재출시 하자마자 품절"…곰돌이컵 중고 가격이? [앵커리포트]](https://image.ytn.co.kr/general/jpg/2025/1231/202512311455186807_h.jpg) "재출시 하자마자 품절"…곰돌이컵 중고 가격이? [앵커리포트]

"재출시 하자마자 품절"…곰돌이컵 중고 가격이? [앵커리포트] -

안성기, 어제(30일) 심정지 상태 병원 이송…현재 중환자실

안성기, 어제(30일) 심정지 상태 병원 이송…현재 중환자실 -

케네디가 비극 반복…30대 케네디 외손녀 희귀암으로 사망

케네디가 비극 반복…30대 케네디 외손녀 희귀암으로 사망 -

"역사상 최악의 은행강도" 독일 금고서 1,450억 털렸다

"역사상 최악의 은행강도" 독일 금고서 1,450억 털렸다 -

재생

’일촉즉발’ 사우디·UAE 대리전…예멘 남부서 충돌

’일촉즉발’ 사우디·UAE 대리전…예멘 남부서 충돌

많이 본 뉴스

- 1 [현장영상+] "역대 정부 최초...내년부터 47개 모든 부처 정책 생중계"

- 2 배우 안성기, 심정지 상태로 병원 이송...중환자실서 위중한 상태 [지금이뉴스]

- 3 다니엘·민희진에 '4백억' 소송...작심한 어도어 갈 때까지 간다 [지금이뉴스]

- 4 "아침부터 줄 서서 샀다"...스벅 '곰돌이 컵' 인기에 리셀가도 폭등 [지금이뉴스]

- 5 [현장영상+] 안규백 "해병대, 해군 소속 유지...준4군체제로 개편 추진"

- 6 난데없는 대국민 사과...정장 입고 사과한 뽀로로에 '웃픈' 댓글 [지금이뉴스]

- 7 청문회에서 '호통' 쿠팡 로저스...오늘도 '마이웨이'

- 8 [속보] 경찰, 오늘 정원주 전 통일교 비서실장 압수수색

- 9 KT, 2주간 위약금 면제..."100GB 데이터·OTT 이용권도"

- 10 2025년 마지막 해넘이...이 시각 태안 꽃지해수욕장

![[Y터뷰] '만약에 우리' 문가영 "구교환과 개그 코드 비슷…나이 차 못 느꼈죠"](https://image.ytn.co.kr/general/jpg/2025/1231/202512310800020399_h.jpg)