Woori, Business, Shinhan Bank to Stop Non-face-to-face Loans..."Managing the total amount of loans"

While the banking sector has begun to manage the total amount of household loans, sales of non-face-to-face loan products have been suspended.

The Industrial Bank of Korea has suspended the sale of three non-face-to-face loan products since the 29th of last month to manage the total amount of household loans temporarily.

Woori Bank also decided not to handle non-face-to-face mortgage products from today to the 8th of next month.

Woori Bank also stopped selling jeonse loan products and reduced preferential interest rates for each credit loan product by up to 0.5%p.

Shinhan Bank will also temporarily stop selling non-face-to-face loan products starting tomorrow (6th).

Banks have stopped handling non-face-to-face loan products one after another because many places have exceeded the annual household loan growth target reported to financial authorities at the beginning of the year.

An official from a commercial bank said, "We have no choice but to cut household loans further to meet the annual total volume management figure."

※ 'Your report becomes news'

[Kakao Talk] YTN Search and Add Channel

[Phone] 02-398-8585

[Mail] social@ytn.co.kr

The Industrial Bank of Korea has suspended the sale of three non-face-to-face loan products since the 29th of last month to manage the total amount of household loans temporarily.

Woori Bank also decided not to handle non-face-to-face mortgage products from today to the 8th of next month.

Woori Bank also stopped selling jeonse loan products and reduced preferential interest rates for each credit loan product by up to 0.5%p.

Shinhan Bank will also temporarily stop selling non-face-to-face loan products starting tomorrow (6th).

Banks have stopped handling non-face-to-face loan products one after another because many places have exceeded the annual household loan growth target reported to financial authorities at the beginning of the year.

An official from a commercial bank said, "We have no choice but to cut household loans further to meet the annual total volume management figure."

※ 'Your report becomes news'

[Kakao Talk] YTN Search and Add Channel

[Phone] 02-398-8585

[Mail] social@ytn.co.kr

[Copyright holder (c) YTN Unauthorized reproduction, redistribution and use of AI data prohibited]

Editor's Recomended News

The Lastest News

-

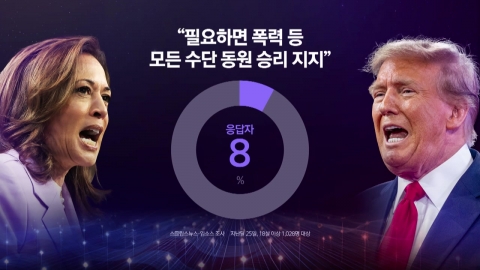

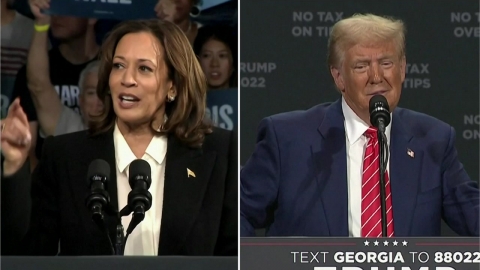

Key Forecast Model, Harris, Trump Win odds 'Shared'

-

재생

U.S. presidential election that just went up...What are the choices of American voters?

U.S. presidential election that just went up...What are the choices of American voters? -

Prosecutors Seizure Kakao Mobility and Other Suspicions of 'Calling All'

-

재생

U.S. Fate Presidential Main Voting Opens..."The prediction of victory is 0.03%p different."

U.S. Fate Presidential Main Voting Opens..."The prediction of victory is 0.03%p different."

Entertainment

Game

-

Gyeonggi Content Agency holds a successful e-sports job briefing session...Provide employment information and custom consulting

-

Nexon's 'Enlightenment Online' CBT Starts on the 21st...Reinterpret the original story to stimulate memories.

-

Faker, 5th star... Team China Beat China to Win 5 LOL World Cups