김용현 전 장관 측, 결심공판에서도 혐의 전면 부인

김용현측 "계엄은 대통령·국방장관의 정당한 권한"

"특검 공소장은 자위적 해석의 픽션·허구"

특검 "반대 세력 제거·권력 독점 수단으로 계엄"

-

특검, 윤석열 구형 불발…오는 13일로 결심 연기재생

- [속보] 윤석열 전 대통령 ’내란 우두머리 혐의’ 재판 종료

- 지귀연 "프로는 징징대지 않는다"…변호인에 ’경고’

- "혀가 짧아서"까지 등장…변호인단 무제한 변론에 막혔다

-

서울·경기 제설 비상근무…폭설·한파 대비 주의 당부재생

-

주말 사이 대설이 예고되면서 서울시와 경기도가 제설 비상근무 체제에 돌입했습니다. 강원도 역시 산간 지역을 중심으로 강풍과 폭설 피해가 우려된다며 주의를 당부했습니다. 박기현 기자가 보도합니다. [기자] 서울시는 서해안의 눈구름대 경로를 실시간 분석하며 밤부터 강설 대응 1단계를 발령하고 비상근무에 돌입했습니다. 제설 대응에는 인력 5천여 명과 장비 천백여 대가 투입됩니다. 고갯길과 급경사지 등 취약 지점에는 제설제도 미리 살포합니다. 경기도 역시 밤부터 재난안전대책본부 비상 1단계를 가동했습니다. 도로와 교통, 철도, 소방, 농업 분야 담당 직원들이 대설에 대비하고 신속 대응하겠다는 계획입니다. 가장 많은 눈이 예보된 지역 가운데 하나인 강원도도 습설로 인한 시설 붕괴와 동해 예방을 위한 사전 조치도 당부했습니다. 물을 잔뜩 머금은 습설이 예보됐을 경우 농업시설물에 미리 보강지주 등을 설치해야 합니다. 또 지붕이나 옥상에 쌓인 눈은 무게로 인한 붕괴 위험이 있어 수시로 치워야 합니다. 한파가 동반될 가능성이 높은 만큼 수도계량기는 헌 옷으로 감싸 동파를 방지하고, 외출 시에는 수도꼭지를 조금 열어 두는게 좋습니다. 각 지자체는 이와 함께 도로 살얼음으로 인한 사고 위험이 큰 만큼 주말 사이 가급적 대중교통 이용을 권장했습니다. YTN 박기현입니다. ※ ’당신의 제보가 뉴스가 됩니다’ [카카오톡] YTN 검색해 채널 추가 [전화] 02-398-8585 [메일] social@ytn.co.kr

![[날씨] 주말 강원, 휴일 서해안…최고 20㎝ ’대설’ 뒤 강력 한파](https://image.ytn.co.kr/general/jpg/2026/0110/202601100005524294_h.jpg)

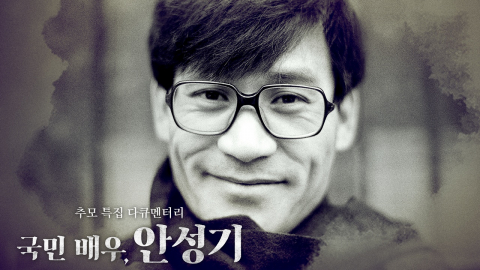

![[Y현장] "작품 속에 살아있을 이름"…'국민 배우' 안성기, 하늘의 별이 되다(종합)](https://image.ytn.co.kr/general/jpg/2026/0109/202601091042149519_h.jpg)

![[Y터뷰] '프로젝트 Y' 전종서 "한소희가 DM 보내 처음 알게 돼…답장했다"](https://image.ytn.co.kr/general/jpg/2026/0109/202601091441089698_h.jpg)

![[Y현장] 정우성, 고 안성기 추도사 "한국영화 온 마음으로 품은 선배님…영면하시길"](https://image.ytn.co.kr/general/jpg/2026/0109/202601091008157730_h.jpg)