-

서산영덕고속도로 30여 대 추돌에 화물차 추락도…5명 숨져재생

-

오늘 오전 서산-영덕 고속도로에서 교통사고가 잇따르면서 5명이 숨졌습니다. 추돌 사고로 피해를 본 차만 30여 대에 달합니다. 취재 기자 전화로 연결합니다. 허성준 기자! 사고 상황 전해주시죠? [기자] 네, 사고가 난 건 오늘 오전 6시 10분쯤입니다. 서산-영덕 고속도로 남상주 나들목 근처인데요. 양방향에서 동시다발로 사고가 났습니다. 영덕 방향으로 달리던 대형 화물차가 가드레일을 뚫고 추락하면서 운전사 1명이 숨졌습니다. 청주 방향에서도 추돌 사고가 여러 건 잇따르면서 4명이 숨졌습니다. 정확한 사망자 신원은 아직 파악되지 않았습니다. 다친 사람은 모두 8명으로 생명에는 지장이 없는 것으로 확인됐습니다. 또 차 30여 대가 불타거나 부서졌습니다. 사고 이후 고속도로에 정체가 이어졌고, 사고 수습을 위해 한때 양방향 통제도 이뤄졌습니다. 현재는 사고 수습이 어느 정도 마무리되면서 양방향 통제는 모두 풀렸습니다. 경찰은 이번 사고가 도로 위 살얼음, 블랙아이스 때문으로 추정하고 있습니다. 당시 약한 비가 내렸고, 기온은 영하 1도였습니다. [앵커] 인근 지역에 눈이 내리면서 도로 곳곳이 통제되고 있다고요. [기자] 네, 사고가 난 경북 북부에는 현재 대설주의보가 내려져 있습니다. 내린 눈이 얼어붙으면서 고속도로와 지방도 곳곳이 통제되고 있습니다. 우선 중앙고속도로 남안동나들목이 통제돼 이 지역을 가는 분들은 서안동나들목으로 우회해야 합니다, 또 지방도 가운데 영주시 봉현면 두산리에서 예천군 효자면 고항리 구간도 통제됐습니다. 청송군 신촌에서 영양군 답곡터널을 잇는 도로도 우회도로를 이용해야 합니다. 이 지역에는 지금까지 8㎝가 넘는 눈이 왔습니다. 기상청은 오늘 밤까지 1∼5㎝의 눈이 더 내릴 것으로 예보했는데요. 기온도 영하권에 머물면서 결빙 구간이 많은 만큼 운전자들의 주의가 필요합니다. 지금까지 대구경북취재본부에서 YTN 허성준입니다. ※ ’당신의 제보가 뉴스가 됩니다’ [카카오톡] YTN 검색해 채널 추가 [전화] 02-398-8585 [메일] social@ytn.co.kr

-

북 "한국 무인기 두 대 격추"…군 "북 주장 일자에 운용 안 해"재생

-

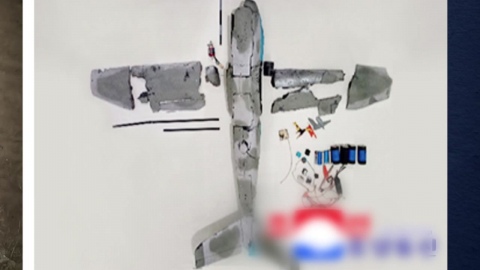

북한이 지난해 9월과 지난 4일 한국이 무인기를 침투시켰다고 주장하며 대가를 각오해야 할 것이라고 위협했습니다. 그러면서 자신들이 격추한 무인기 잔해를 공개했는데요. 국방부는 북한이 주장하는 일자에 무인기를 운용한 사실은 없다고 밝혔습니다. 취재기자 연결해 알아보겠습니다. 김문경 기자! 먼저 북한이 주장한 내용부터 전해주시죠. [기자] 네, 북한 인민군 총참모부는 조선중앙통신을 통해 한국이 무인기를 침투시켜 격추했다고 주장했습니다. 북한은 무인기를 격추한 시점은 지난해 9월과 지난 4일이라며 이같이 밝혔는데요. 그러면서 주권 침해 도발을 다시 감행한 데 대한 대가를 각오해야 할 것이라고 위협했습니다. 북한은 무인기의 동선과 탑재 장비 등에 대해서도 자세히 밝혔습니다. 지난 4일 인천시 강화군 송해면 일대에서 출발한 무인기는 개성시 개풍구역 묵산리 부근에서 특수한 전자전 자산들로 추락시켰고, 지난해 9월 경기도 파주시 적성면 일대에서 이륙해 북으로 침투한 무인기는 황해북도 평산군을 거쳐 개성시 상공을 통해 귀환하다 전자공격을 받고 논에 추락했다고 덧붙였습니다. 이어 지난 4일 추락한 무인기엔 감시용 장비들이, 지난해 9월 침투했던 무인기에도 북측 지역을 5시간 47분 분량을 촬영한 영상자료가 들어있었다고 전했습니다. 북한 인민군 총참모부 대변인은 한국군의 각종 반무인기 장비들이 집중 배치된 지역 상공을 제한 없이 통과했다는 건, 무인기 침입 사건의 배후를 어렵지 않게 짐작할 수 있게 해준다고 주장했습니다. [앵커] 우리 군은 북한의 이런 주장에 대해 뭐라고 밝혔나요. [기자] 국방부는 북한이 주장하는 날짜에 우리 군이 무인기를 운용한 사실이 없는 것으로 확인되고 있다고 밝혔습니다. 그러면서 이 대통령이 철저한 조사를 지시해 세부 사항은 관련 기관에서 추가로 확인 중에 있다고 덧붙였습니다. 청와대도 국가안보실 1차장 주재로 국가안전보장회의 실무조정회의를 예고했습니다. 북한이 공개한 무인기를 분석한 민간 군 전문가는 두 대 모두 같은 형태로 보인다고 전했습니다. 그러면서 부품엔 픽스호크사라는 기업의 비행조정 컨트롤러, 삼성 메모리 등이 섞여 있다며 군이 아닌 민간이 조립해 날렸을 가능성에 무게를 뒀습니다. 북한은 의사소통을 위해 바늘 끝 만한 구멍이라도 뚫어야 한다면서도 도발 행위를 멈추지 않는 한국에 대한 적대적 인식을 다시 갖게 했다고 밝혔는데, 향후 남북관계에 미칠 영향이 주목됩니다. 지금까지 정치부에서 YTN 김문경입니다. ※ ’당신의 제보가 뉴스가 됩니다’ [카카오톡] YTN 검색해 채널 추가 [전화] 02-398-8585 [메일] social@ytn.co.kr

![[날씨] 강원·경상권 비·눈…내일은 한파 속 서해안 폭설](https://image.ytn.co.kr/general/jpg/2026/0110/202601101159098242_h.jpg)

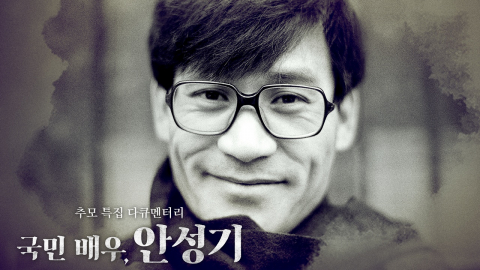

![[Y현장] "작품 속에 살아있을 이름"…'국민 배우' 안성기, 하늘의 별이 되다(종합)](https://image.ytn.co.kr/general/jpg/2026/0109/202601091042149519_h.jpg)

![[Y터뷰] '프로젝트 Y' 전종서 "한소희가 DM 보내 처음 알게 돼…답장했다"](https://image.ytn.co.kr/general/jpg/2026/0109/202601091441089698_h.jpg)

![[Y현장] 정우성, 고 안성기 추도사 "한국영화 온 마음으로 품은 선배님…영면하시길"](https://image.ytn.co.kr/general/jpg/2026/0109/202601091008157730_h.jpg)