Trump's China Tariff Card...Responding to China's 'currency war'?

The New York Times (NYT) reported that U.S. President-elect Trump's plan to impose tariffs is drawing attention whether it will lead to a "currency war" between the U.S. and China.

"China has a powerful tool (artificial yuan devaluation) to counter Trump's tariff threat," the NYT said, before adding, "China could start a currency war."It pointed out that devaluing the yuan in response to

{Trump tariffs} could ultimately make overseas buyers buy Chinese products at cheaper prices.

The Chinese government has already responded with a so-called "strategic yuan devaluation" when the U.S. imposed high tariffs in 2018 and 2019 during Trump's first term.

The New York Times predicted that as Trump took out the tariff card before he even took office, China could also be tempted to devalue the yuan before January 20 next year, when Trump takes office.

However, he pointed out that an artificial devaluation of the yuan could put the Chinese economy at risk by Chinese companies and the wealthy not investing in the country, but by moving capital out of the country.

It also discovered that the Chinese public's confidence in the Chinese economy could be undermined, which could be followed by lower consumer spending and lower stock prices.

At the same time, Trump pointed out that during his first term in office, he only discussed how to counteract China's yuan devaluation with the dollar devaluation, but did not implement it, but it remains to be seen whether he will refrain from doing so in his second term in office.

Some experts predicted that China's devaluation of the yuan could "risk being a provocation aimed at the angry Trump administration" and that Trump could respond by raising tariffs further.

※ 'Your report becomes news'

[Kakao Talk] YTN Search and Add Channel

[Phone] 02-398-8585

[Mail] social@ytn.co.kr

"China has a powerful tool (artificial yuan devaluation) to counter Trump's tariff threat," the NYT said, before adding, "China could start a currency war."It pointed out that devaluing the yuan in response to

{Trump tariffs} could ultimately make overseas buyers buy Chinese products at cheaper prices.

The Chinese government has already responded with a so-called "strategic yuan devaluation" when the U.S. imposed high tariffs in 2018 and 2019 during Trump's first term.

The New York Times predicted that as Trump took out the tariff card before he even took office, China could also be tempted to devalue the yuan before January 20 next year, when Trump takes office.

However, he pointed out that an artificial devaluation of the yuan could put the Chinese economy at risk by Chinese companies and the wealthy not investing in the country, but by moving capital out of the country.

It also discovered that the Chinese public's confidence in the Chinese economy could be undermined, which could be followed by lower consumer spending and lower stock prices.

At the same time, Trump pointed out that during his first term in office, he only discussed how to counteract China's yuan devaluation with the dollar devaluation, but did not implement it, but it remains to be seen whether he will refrain from doing so in his second term in office.

Some experts predicted that China's devaluation of the yuan could "risk being a provocation aimed at the angry Trump administration" and that Trump could respond by raising tariffs further.

※ 'Your report becomes news'

[Kakao Talk] YTN Search and Add Channel

[Phone] 02-398-8585

[Mail] social@ytn.co.kr

[Copyright holder (c) YTN Unauthorized reproduction, redistribution and use of AI data prohibited]

Editor's Recomended News

-

[News NIGHT] "Mungabi's son, 100% inheritance right"...Jung Woo-sung, shall we make an additional announcement?

![[News NIGHT] "Mungabi\'s son, 100% inheritance right"...Jung Woo-sung, shall we make an additional announcement?](//image.ytn.co.kr/general/jpg/2024/1126/202411262243524775_h.jpg)

-

[News NIGHT] "I'm skipping from a university". Spreading community posts... Ministry of Employment and Labor launches investigation

![[News NIGHT] "I\'m skipping from a university". Spreading community posts... Ministry of Employment and Labor launches investigation](//image.ytn.co.kr/general/jpg/2024/1126/202411262244149233_h.jpg)

-

North Korea, this time, cut the wire of the transmission tower...Inter-Korean Disruption Activities Continued

The Lastest News

-

재생

A man and woman in their 50s were found stabbed in a highway vehicle...One person died.

A man and woman in their 50s were found stabbed in a highway vehicle...One person died. -

재생

Prosecutors at the Central District Prosecutors' Office are protesting against the prosecutor's impeachment... "unconstitutional impeachment."

Prosecutors at the Central District Prosecutors' Office are protesting against the prosecutor's impeachment... "unconstitutional impeachment." -

재생

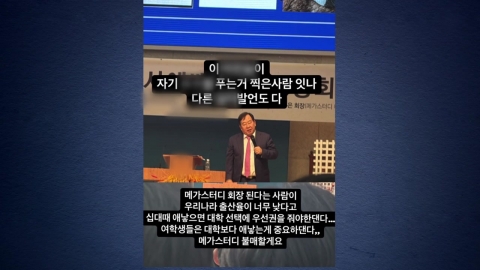

"If you give birth to a teenager, you should let me go to college".The Mega Study Chairman's Remarks Controversy

"If you give birth to a teenager, you should let me go to college".The Mega Study Chairman's Remarks Controversy -

재생

![(Video composition) [Salvation] Bell of Hope, Salvation Army Charity Pot](https://image.ytn.co.kr/general/jpg/2024/1127/202411270125547185_h.jpg) (Video composition) [Salvation] Bell of Hope, Salvation Army Charity Pot

(Video composition) [Salvation] Bell of Hope, Salvation Army Charity Pot

![[News NIGHT] "Mungabi\'s son, 100% inheritance right"...Jung Woo-sung, shall we make an additional announcement?](http://image.ytn.co.kr/general/jpg/2024/1126/202411262243524775_h.jpg)

![[News NIGHT] "I\'m skipping from a university". Spreading community posts... Ministry of Employment and Labor launches investigation](http://image.ytn.co.kr/general/jpg/2024/1126/202411262244149233_h.jpg)

![[Yetterview] Dixon's youth who overcomes wandering for 2 years and 9 months and runs again.](https://image.ytn.co.kr/general/jpg/2024/1126/202411261616521790_h.jpg)