US Treasuries to mature in New Year's $3 trillion...An alarm for the bond market

2025.01.02 AM 06:45

With the size of U.S. government bonds scheduled to mature in 2025 reaching $3 trillion, the large proportion of short-term bonds is a potential destabilizing factor in the bond market in the new year, CNBC reported.

The amount of government bonds issued by the U.S. Treasury between January and November 2024 was $26.7 trillion, a 28.5% jump from 2023. Many of the new bonds were short-lived bonds.

In particular, the ratio of short-term bonds among government bonds is estimated to be more than 20% at the usual level, as the size of U.S. government bonds due in 2025 reaches $3 trillion and the Treasury has increased the proportion of short-term bonds issued in recent years.

"This will be a bigger concern for the bond market this year than the fiscal deficit as the U.S. government converts short-term bonds into bonds with a maturity of five to 10 years," market analyst Stratigus warned.

Since issuing mid- and long-term bonds typically raises interest rates, the value of existing bonds can decline.

※ 'Your report becomes news'

[Kakao Talk] YTN Search and Add Channel

[Phone] 02-398-8585

[Mail] social@ytn.co.kr

The amount of government bonds issued by the U.S. Treasury between January and November 2024 was $26.7 trillion, a 28.5% jump from 2023. Many of the new bonds were short-lived bonds.

In particular, the ratio of short-term bonds among government bonds is estimated to be more than 20% at the usual level, as the size of U.S. government bonds due in 2025 reaches $3 trillion and the Treasury has increased the proportion of short-term bonds issued in recent years.

"This will be a bigger concern for the bond market this year than the fiscal deficit as the U.S. government converts short-term bonds into bonds with a maturity of five to 10 years," market analyst Stratigus warned.

Since issuing mid- and long-term bonds typically raises interest rates, the value of existing bonds can decline.

※ 'Your report becomes news'

[Kakao Talk] YTN Search and Add Channel

[Phone] 02-398-8585

[Mail] social@ytn.co.kr

[Copyright holder (c) YTN Unauthorized reproduction, redistribution and use of AI data prohibited]

Editor's Recomended News

-

The police have notified the security chief of the second round of subpoenas...Employees may also face criminal punishment.

-

The president appears 141 times...Six hours from the declaration of martial law to the lifting of the martial law.

-

"Military mobilization" controversy continues...Ministry of National Defense Re-requires Security Service to 'Do Not Mobilize'

The Lastest News

-

재생

He's mocking the bereaved family and fake news.Investigation launched into 'Online Insult' of Jeju Air disaster

He's mocking the bereaved family and fake news.Investigation launched into 'Online Insult' of Jeju Air disaster -

재생

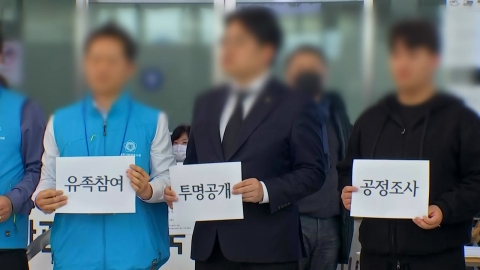

The bereaved family of the Jeju Air disaster "The Ministry of Land, Infrastructure and Transport investigates itself...independent investigation required"

The bereaved family of the Jeju Air disaster "The Ministry of Land, Infrastructure and Transport investigates itself...independent investigation required" -

재생

The Ministry of Land, Infrastructure and Transport has additional aircraft engines...Investigation of landing gear

The Ministry of Land, Infrastructure and Transport has additional aircraft engines...Investigation of landing gear -

재생

The last day of the national mourning period...'A wave of remembrance' all over the country

The last day of the national mourning period...'A wave of remembrance' all over the country