-

’이틀 파업’ 서울 시내버스 운행 재개…노사 협상 ’타결’재생

-

파업으로 이틀 동안 중단한 서울 시내버스 운행이 재개됐습니다. 서울 시내버스 노사는 9시간 가까이 마라톤협상 끝에 어젯밤 극적으로 합의에 이르렀습니다. 사당역 버스정류장에 나가 있는 현장 취재기자 연결합니다. 양일혁 기자! 서울 시내버스 운행 정상화로 출근길 시민들 표정이 한결 밝아졌죠. [기자] 저는 지금 사당역 인근 버스정류장에 나와 있습니다. 평소 서울과 경기도를 오가며 출퇴근하는 시민들로 북적이는 곳인데요. 지금은 보시는 것처럼 새벽 4시 첫차부터 시내버스가 정상 운행하고 있습니다. 어제와 그제 서울 시내버스 운행 중단으로 매서운 추위 속에 출퇴근길 시민들이 애를 먹었습니다. 파업 기간 버스 전광판엔 야속하게 ’차고지’에 있다는 알림 표시만 떠 있었는데, 지금은 몇 분 뒤 도착 예정인지로 바뀌어 있습니다. 아직 이른 시각이라 출근길 시민들이 많지는 않은데요. 파업 때처럼 발을 동동 구르며 대체 교통편을 찾는 일은 보이지 않습니다. 어젯밤 늦게 노사 협상이 타결됐단 소식에 시민들은 가슴을 쓸어내리며 출근길에 나선 모습입니다. 시내버스 운행이 정상화하면서 서울시는 비상수송대책을 해제하고, 운행 횟수를 늘렸던 지하철도 평시 운행으로 돌아갑니다. [앵커] 어제 협상에 들어간 서울 시내버스 노사가 또다시 합의에 이르지 못하면 어쩌나 마음 졸이는 시민들 많았을 텐데 다행히 타결됐습니다. 합의문에 서명하기까지 과정이 순탄치 않았던 거죠. [기자] 노사에 타결 과정, 말 그대로 극적이었습니다. 보통 다음날 첫차부터 파업을 멈추고 운행에 들어가기 위한 마지노선을 자정으로 보는데요. 어젯밤 자정을 10분 정도 남겨놓고 노사가 합의에 이르렀습니다. 노사가 두 번째 사후 조정회의를 시작한 게 어제 오후 3시였으니까, 무려 9시간 가까이 마라톤협상이 이어진 겁니다. 협상 과정도 순탄치 않았습니다. 협상 도중 고성이 터져 나오거나 회의장을 박차고 나오는 모습이 포착돼 결렬로 끝나나 싶은 순간도 있었습니다. 하지만 막판에 노사가 입장 차를 좁히면서 양측 모두 조정안에 서명했습니다. 이번 협상에 가장 큰 걸림돌이었던 조합원 임금을 2.9% 인상하는 데 합의했고요. 정년도 현재 만 63세에서 내년 만 65세까지 단계적으로 2년 연장하기로 했습니다. 최대 쟁점이었던 정기상여금의 통상임금 반영 문제는 추후 논의하기로 했습니다. 노조가 애초에 요구했던 임금 인상률에서 0.1%를 양보한 것을 제외하면 노조 측 요구가 대부분 받아들여진 셈입니다. 지금까지 사당역 버스정류장에서 YTN 양일혁 입니다. ※ ’당신의 제보가 뉴스가 됩니다’ [카카오톡] YTN 검색해 채널 추가 [전화] 02-398-8585 [메일] social@ytn.co.kr

-

김경 "1억 줄 때 강선우도 있어"…오늘 오전 2차 소환재생

- [단독] 경찰, 김병기 부부 '대형 금고' 추적…"1m 크기 추정"

- "돈 준 구의원들 또 있다"…’김병기 정치헌금’ 의혹 번지나?

- 민주당 "김병기 재심, 1월 말 결론 예상"…’시간표’ 제시

-

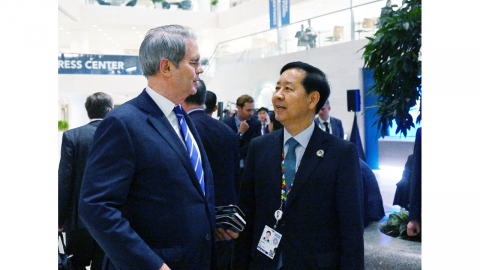

’교류 역사’ 호류지 함께 방문…드럼 세트 선물도재생

-

한일 정상회담에서 양국 관계 발전의 중요성에 공감한 이재명 대통령과 다카이치 총리가 한일 교류 역사가 깃든 문화 유적지, ’호류지’를 함께 방문했습니다. 이 대통령은 ’드럼 합주’ 깜짝 이벤트를 준비했던 다카이치 총리에게 한국산 드럼 세트도 선물했습니다. 강진원 기자의 보도입니다. [기자] ’백제 관음’으로 불리는 목조 관음보살입상이 있는 호류지. 일본 나라 현의 대표적 유적지에 이재명 대통령이 도착하자, 미리 와서 기다리던 다카이치 총리가 반갑게 맞이합니다. 사찰 관계자의 안내를 받으며, 한일 교류 역사가 깃든 고찰 내부 곳곳을 함께 둘러봅니다. [이 재 명 / 대통령 : 정말 대단합니다.] ’우호와 협력 정신’이 담긴 과거를 돌아보며, 미래지향적 한일 관계 발전 의지를 다진 겁니다. 두 정상은 선물도 주고받았습니다. 이재명 대통령은 드럼 애호가인 다카이치 총리에게 한국산 드럼 세트를 건넸습니다. 앞서 ’드럼 합주’ 깜짝 이벤트 뒤 드럼 스틱을 줬던 다카이치 총리에게 화답한 셈이 됐습니다. [다카이치 사나에 / 일본 총리 (그제) : 감사합니다.] 한국의 대표 건강식품인 홍삼과 삼성 갤럭시 워치 등도 환대에 대한 감사의 뜻으로 전했습니다. 다카이치 총리는 일본 브랜드인 카시오 손목시계와 김혜경 여사를 위한 화장용 붓 등을 준비했습니다. 1박 2일의 짧은 일정이었지만, 양국 정상은 모두 5차례에 걸쳐 대화를 나누는 시간을 가졌습니다. 의전이나 격식에 얽매이지 않고 수시로 상대국을 오가며 주요 현안을 논의하는 ’한일 셔틀 외교’가 본궤도에 올랐다는 평가가 나오고 있습니다. 오사카에서 YTN 강진원입니다. 영상기자 : 최영욱 최광현 영상편집;서영미 ※ ’당신의 제보가 뉴스가 됩니다’ [카카오톡] YTN 검색해 채널 추가 [전화] 02-398-8585 [메일] social@ytn.co.kr

![’비계 삼겹살’ 논란 끝?…"지방 비율로 삼겹살 세분화" [앵커리포트]](https://image.ytn.co.kr/general/jpg/2026/0114/202601142243316273_h.jpg)

![올리브영 빈자리에 ’온리영’?…중국판 짝퉁 꼼수 [앵커리포트]](https://image.ytn.co.kr/general/jpg/2026/0114/202601142244287738_h.jpg)

![[날씨] 밤사이 눈비·살얼음 '비상'…주말까지 온탕 뒤 냉탕](https://image.ytn.co.kr/general/jpg/2026/0115/202601150123313899_h.jpg)

![[Y현장] “연프인지 ‘스우파’인지”…‘솔로지옥5’, 선 넘은 직진 테토녀 전쟁 온다](https://image.ytn.co.kr/general/jpg/2026/0114/202601141251048482_h.jpg)