Base rate cut by 0.25%p...Monetary easing for the first time in three years and two months

BOK slashes key rate by 0.25% to 3.5% → 3.25%

Longest freeze march 'end' changes monetary policy in three years and two months

Background of U.S. rate cuts, slowing inflation and household debt growth

Longest freeze march 'end' changes monetary policy in three years and two months

Background of U.S. rate cuts, slowing inflation and household debt growth

[Anchor]

The Bank of Korea's Monetary Policy Committee today cut its key interest rate for the first time in three years and two months since it began raising the rate in 2021.We dropped 0.25%p from

3.5%.

This is to revive the domestic economy, which has been suppressed by high interest rates and prices.

Connect with reporters to find out more.

Reporter Lee Seung-eun, please explain why the Bank of Korea's Monetary Policy Committee cut interest rates.

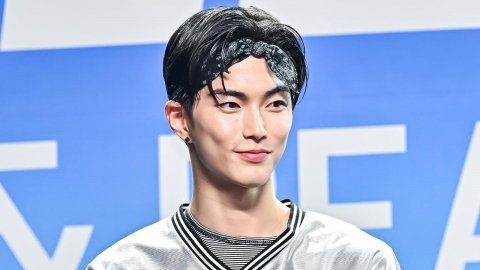

[Reporter]

Yes, the Bank of Korea's Monetary Policy Committee lowered its key interest rate by 0.25 percentage point from 3.5 percent to 3.25 percent.

It has changed its monetary policy in three years and two months after 13 frozen marches since February last year.

Let's listen to Lee Chang-yong, the governor of the Bank of Korea.

[Lee Chang-yong / Governor of the Bank of Korea: First of all, the need to ease the tightening by cutting interest rates has increased as inflation has strengthened monetary tightening in terms of real interest rates and uncertainties in growth prospects have increased. On the other hand, in terms of financial stability, as household debt measures began to take effect, the government said it would implement additional measures if necessary, and the U.S. Federal Reserve shifted its policy stance, easing the burden on the foreign exchange sector. Therefore, it is appropriate to cut the base rate by 25 basis points today and check its impact and internal and external policy conditions.]

The U.S. rate cut and inflation and household debt growth slowed significantly behind the rate cut.

Consumer price growth was 1.6 percent last month, the lowest in three and a half years.

Household loans in the banking sector increased by 5.7 trillion won last month, down 39% from August, when it surged.

The increase in apartment prices in Seoul in the first week of October, which was announced yesterday, was also 0.1%, slowing the growth rate for the fourth week.

Against this backdrop, the need to support the domestic economy, which has been suppressed by high interest rates and high prices, has grown.

Real GDP fell 0.2% in the second quarter from the first quarter as private consumption and investment fell together.

At a press conference, Lee Chang-yong said he could afford to cut the key interest rate further for the time being.

However, he said, "It is not a situation that will be lowered by 0.5%p like the U.S.," adding, "We will decide the speed by looking at the financial stability situation."

Regarding the so-called "zero-class," he said that if you want to invest in a gap, you should consider how much you can afford financial costs, and that the debt-to-principal repayment ratio and DSR regulations should be expanded in the mid- to long-term.

At the same time, some people said that the Bank of Korea did not cut interest rates in August, but emphasized that household loans increased by nearly 10 trillion won.

Even if the loan interest rate falls only by the cut in the benchmark interest rate, the household loan interest burden is estimated to decrease by 3 trillion won per year, according to the Bank of Korea's estimate.

However, attention is being paid to the ripple effect and countermeasures in the future as there is a concern that the household debt growth, which has slowed due to strong regulations, will revive.

I'm Lee Seung Eun of YTN.

※ 'Your report becomes news'

[Kakao Talk] YTN Search and Add Channel

[Phone] 02-398-8585

[Mail] social@ytn.co.kr

The Bank of Korea's Monetary Policy Committee today cut its key interest rate for the first time in three years and two months since it began raising the rate in 2021.We dropped 0.25%p from

This is to revive the domestic economy, which has been suppressed by high interest rates and prices.

Connect with reporters to find out more.

Reporter Lee Seung-eun, please explain why the Bank of Korea's Monetary Policy Committee cut interest rates.

[Reporter]

Yes, the Bank of Korea's Monetary Policy Committee lowered its key interest rate by 0.25 percentage point from 3.5 percent to 3.25 percent.

It has changed its monetary policy in three years and two months after 13 frozen marches since February last year.

Let's listen to Lee Chang-yong, the governor of the Bank of Korea.

[Lee Chang-yong / Governor of the Bank of Korea: First of all, the need to ease the tightening by cutting interest rates has increased as inflation has strengthened monetary tightening in terms of real interest rates and uncertainties in growth prospects have increased. On the other hand, in terms of financial stability, as household debt measures began to take effect, the government said it would implement additional measures if necessary, and the U.S. Federal Reserve shifted its policy stance, easing the burden on the foreign exchange sector. Therefore, it is appropriate to cut the base rate by 25 basis points today and check its impact and internal and external policy conditions.]

The U.S. rate cut and inflation and household debt growth slowed significantly behind the rate cut.

Consumer price growth was 1.6 percent last month, the lowest in three and a half years.

Household loans in the banking sector increased by 5.7 trillion won last month, down 39% from August, when it surged.

The increase in apartment prices in Seoul in the first week of October, which was announced yesterday, was also 0.1%, slowing the growth rate for the fourth week.

Against this backdrop, the need to support the domestic economy, which has been suppressed by high interest rates and high prices, has grown.

Real GDP fell 0.2% in the second quarter from the first quarter as private consumption and investment fell together.

At a press conference, Lee Chang-yong said he could afford to cut the key interest rate further for the time being.

However, he said, "It is not a situation that will be lowered by 0.5%p like the U.S.," adding, "We will decide the speed by looking at the financial stability situation."

Regarding the so-called "zero-class," he said that if you want to invest in a gap, you should consider how much you can afford financial costs, and that the debt-to-principal repayment ratio and DSR regulations should be expanded in the mid- to long-term.

At the same time, some people said that the Bank of Korea did not cut interest rates in August, but emphasized that household loans increased by nearly 10 trillion won.

Even if the loan interest rate falls only by the cut in the benchmark interest rate, the household loan interest burden is estimated to decrease by 3 trillion won per year, according to the Bank of Korea's estimate.

However, attention is being paid to the ripple effect and countermeasures in the future as there is a concern that the household debt growth, which has slowed due to strong regulations, will revive.

I'm Lee Seung Eun of YTN.

[Kakao Talk] YTN Search and Add Channel

[Phone] 02-398-8585

[Mail] social@ytn.co.kr

[Copyright holder (c) YTN Unauthorized reproduction, redistribution and use of AI data prohibited]

Editor's Recomended News

AD

The Lastest News

-

재생

!["Rap your organs with a 70cm stick"...The bereaved family "died due to insufficient police response" [Y Record]](https://image.ytn.co.kr/general/jpg/2024/1011/202410111608063091_h.jpg) "Rap your organs with a 70cm stick"...The bereaved family "died due to insufficient police response" [Y Record]

"Rap your organs with a 70cm stick"...The bereaved family "died due to insufficient police response" [Y Record] -

The Paris Paralympics also welcome the team...harvesting nine silver and bronze medals

-

Human Rights Commission said, "Golf clubs where only men can be full members, infringement of equal rights."

-

재생

Impeachment clash..."Lee Jae Myung, BTS" vs "Mrs. Lee, heavyweight"

Impeachment clash..."Lee Jae Myung, BTS" vs "Mrs. Lee, heavyweight"

![[After playing the game] Between](https://image.ytn.co.kr/general/jpg/2024/1011/202410111054554736_h.jpg)