[Capture News] After "Trump's Seizure", another bad news...KOSPI and Won 'collapse'

The dark clouds in our stock market are not clearing up.

Today, the KOSPI started at 2,413.05, down 0.24% and fell below the 2,400-point level as it increased its fall.

It is the first time that the KOSPI has given up the 2,400-point level since "Black Monday" in August.

The KOSPI is currently moving around the 2,400 mark.

However, Samsung Electronics, which fell to 40,000 electronics, rose to the KRW 50,000 level due to the influx of low-priced purchases.

The KOSDAQ started lower at 675.64, down 0.87%.

Now, the KOSDAQ is showing a downward trend at the early 670 level.

The exchange rate seems to stick to the 1,400 won range.

Today, the won-dollar exchange rate started well over 1,400 won.

It opened at 1,408 won, up 2.9 won from yesterday.

The won-dollar exchange rate has been rising and falling in the 1,407 won range.

As the exchange rate did not fall below the psychological Maginot line of 1,400 won, the foreign exchange authorities even intervened verbally yesterday.

If the exchange rate instability continues, it has sent a message that it will take market stabilization measures, but it is not working.

Former U.S. President Trump, who is about to return to power, is advocating his country's priority.

As trade disputes and concerns over high prices grow, the dollar is strengthening.

On top of that, Powell's bad news overlapped.

Overnight, Jerome Powell, chairman of the Federal Reserve, expressed his intention to adjust the pace of the base rate cut, giving a boost to the strong dollar.

Powell said there is a high possibility that interest rates should be lowered slowly and carefully, fearing inflation.The New York Stock Exchange also closed lower as concerns grew that interest rate cuts in

would be put on hold.

It is analyzed that the won and stock prices are falling as the aftermath hits our financial market.

So far, I'm Hwang Bo Hye-kyung on the Korea Exchange.

subtitle news|This line

#YTN Caption News

Today, the KOSPI started at 2,413.05, down 0.24% and fell below the 2,400-point level as it increased its fall.

It is the first time that the KOSPI has given up the 2,400-point level since "Black Monday" in August.

The KOSPI is currently moving around the 2,400 mark.

However, Samsung Electronics, which fell to 40,000 electronics, rose to the KRW 50,000 level due to the influx of low-priced purchases.

The KOSDAQ started lower at 675.64, down 0.87%.

Now, the KOSDAQ is showing a downward trend at the early 670 level.

The exchange rate seems to stick to the 1,400 won range.

Today, the won-dollar exchange rate started well over 1,400 won.

It opened at 1,408 won, up 2.9 won from yesterday.

The won-dollar exchange rate has been rising and falling in the 1,407 won range.

As the exchange rate did not fall below the psychological Maginot line of 1,400 won, the foreign exchange authorities even intervened verbally yesterday.

If the exchange rate instability continues, it has sent a message that it will take market stabilization measures, but it is not working.

Former U.S. President Trump, who is about to return to power, is advocating his country's priority.

As trade disputes and concerns over high prices grow, the dollar is strengthening.

On top of that, Powell's bad news overlapped.

Overnight, Jerome Powell, chairman of the Federal Reserve, expressed his intention to adjust the pace of the base rate cut, giving a boost to the strong dollar.

Powell said there is a high possibility that interest rates should be lowered slowly and carefully, fearing inflation.The New York Stock Exchange also closed lower as concerns grew that interest rate cuts in

would be put on hold.

It is analyzed that the won and stock prices are falling as the aftermath hits our financial market.

So far, I'm Hwang Bo Hye-kyung on the Korea Exchange.

subtitle news|This line

#YTN Caption News

[Copyright holder (c) YTN Unauthorized reproduction, redistribution and use of AI data prohibited]

Editor's Recomended News

The Lastest News

-

재생

Crash after commuter bus crash...25 casualties in a series of traffic accidents

Crash after commuter bus crash...25 casualties in a series of traffic accidents -

"Detective, thank you".Why did my brother, who killed his younger brother, bow to the police?

"Detective, thank you".Why did my brother, who killed his younger brother, bow to the police? -

재생

!["Running Stock Exchange"...Kospi 'Turned Blue' by Trump's U.S. Firstism [Anchor Report]](https://image.ytn.co.kr/general/jpg/2024/1115/202411151252177110_h.jpg) "Running Stock Exchange"...Kospi 'Turned Blue' by Trump's U.S. Firstism [Anchor Report]

"Running Stock Exchange"...Kospi 'Turned Blue' by Trump's U.S. Firstism [Anchor Report] -

재생

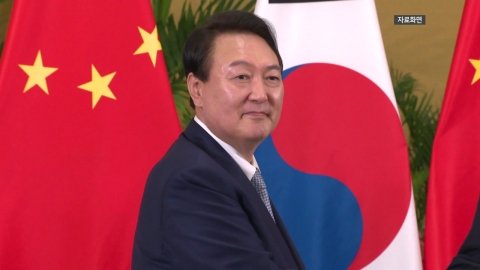

"President Yoon is scheduled to hold bilateral talks with China and Japan...Trump's meeting will be difficult.

"President Yoon is scheduled to hold bilateral talks with China and Japan...Trump's meeting will be difficult.

![[Weather] After the weekend, "Autumn is over"...It\'s freezing next week.](http://image.ytn.co.kr/general/jpg/2024/1115/202411151003072601_h.jpg)

![[2024 G-Star] Nexon catches the attention of users with four new products.](https://image.ytn.co.kr/general/jpg/2024/1115/202411151145188909_h.jpg)