"Running Stock Exchange"...Kospi 'Turned Blue' by Trump's U.S. Firstism [Anchor Report]

Ask a professional about a hot issue.

It's an issue call.

Since the launch of Trump's second term, domestic and foreign stock markets have fluctuated significantly.

U.S. President-elect Trump has named Tesla CEO Elon Musk as the next head of the U.S. administration's government efficiency department.

Since the presidential election, Tesla's stock has surged around 40%, running solidly.

Tesla shares fell 5.8% on forecasts that demand would shrink after Trump later said he would abolish the IRA EV tax credit,

However, some analysts say that the current situation cannot be concluded to be negative for Tesla.

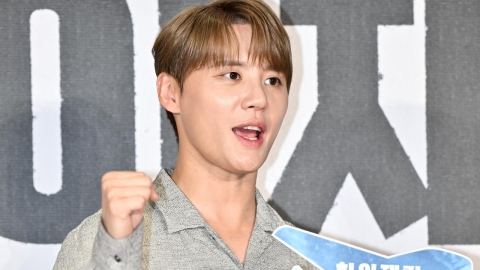

[Lee In-cheol / Director of Economic Research: Tesla's stock price has risen a lot since Trump was elected. Since it was good enough to include seven Magnificent stocks as it topped $1 trillion in market capitalization by the end of last weekend, (the drop) is likely to be profit-taking from a short-term surge and actually took the White House to lead innovation and efficiency, will Trump revise the bill to hurt his country, especially Tesla? I think we have to watch this part.]

As Trump's U.S. priority is sucking up all of the world's investment funds to the U.S., interest and worry about Samsung Electronics' stock prices have also grown.

Although it has recovered to the 50,000 won level now, yesterday it fell to the 40,000 won level for the first time in four years and five months,

The recent decline in semiconductor exports and other deterioration in performance were also attributed to the analysis.

[Lee In-cheol / Director of Economic Research: AI chips are not showing any results, and during the third quarter's earnings announcement, the company indicated the possibility of delivering 8th-tier 5th-generation chips to Nvidia soon, but it has not been approved yet. In addition, China is closely following general-purpose products. As the gap widens between TSMC and non-memory foundry, Samsung Electronics does not have any merit to buy shares right now, as it is contemplating whether the business should be narrowed down a little.

The domestic KOSPI fell below 2,400 for the first time in three months this morning, and the KOSDAQ is also slowing down.

When the domestic stock market, which has turned blue since Trump's election, will properly raise its head, and concerns are expected to continue for the time being.

※ 'Your report becomes news'

[Kakao Talk] YTN Search and Add Channel

[Phone] 02-398-8585

[Mail] social@ytn.co.kr

It's an issue call.

Since the launch of Trump's second term, domestic and foreign stock markets have fluctuated significantly.

U.S. President-elect Trump has named Tesla CEO Elon Musk as the next head of the U.S. administration's government efficiency department.

Since the presidential election, Tesla's stock has surged around 40%, running solidly.

Tesla shares fell 5.8% on forecasts that demand would shrink after Trump later said he would abolish the IRA EV tax credit,

However, some analysts say that the current situation cannot be concluded to be negative for Tesla.

[Lee In-cheol / Director of Economic Research: Tesla's stock price has risen a lot since Trump was elected. Since it was good enough to include seven Magnificent stocks as it topped $1 trillion in market capitalization by the end of last weekend, (the drop) is likely to be profit-taking from a short-term surge and actually took the White House to lead innovation and efficiency, will Trump revise the bill to hurt his country, especially Tesla? I think we have to watch this part.]

As Trump's U.S. priority is sucking up all of the world's investment funds to the U.S., interest and worry about Samsung Electronics' stock prices have also grown.

Although it has recovered to the 50,000 won level now, yesterday it fell to the 40,000 won level for the first time in four years and five months,

The recent decline in semiconductor exports and other deterioration in performance were also attributed to the analysis.

[Lee In-cheol / Director of Economic Research: AI chips are not showing any results, and during the third quarter's earnings announcement, the company indicated the possibility of delivering 8th-tier 5th-generation chips to Nvidia soon, but it has not been approved yet. In addition, China is closely following general-purpose products. As the gap widens between TSMC and non-memory foundry, Samsung Electronics does not have any merit to buy shares right now, as it is contemplating whether the business should be narrowed down a little.

The domestic KOSPI fell below 2,400 for the first time in three months this morning, and the KOSDAQ is also slowing down.

When the domestic stock market, which has turned blue since Trump's election, will properly raise its head, and concerns are expected to continue for the time being.

※ 'Your report becomes news'

[Kakao Talk] YTN Search and Add Channel

[Phone] 02-398-8585

[Mail] social@ytn.co.kr

[Copyright holder (c) YTN Unauthorized reproduction, redistribution and use of AI data prohibited]

Editor's Recomended News

The Lastest News

-

Vice Unification Minister "The situation has become difficult for the U.S. and North Korea to offer dialogue"

-

Lee Joon-seok said, "President, you shouldn't be nominated.""Seeing people and intervening"

-

Google AI "Humans are the burden of society...Please die."

Google AI "Humans are the burden of society...Please die." -

"It's too hard.""…Only 18% of the elderly who know how to order kiosks at restaurants.

"It's too hard.""…Only 18% of the elderly who know how to order kiosks at restaurants.

![[Weather] After the weekend, "Autumn is over"...It\'s freezing next week.](http://image.ytn.co.kr/general/jpg/2024/1115/202411151003072601_h.jpg)

![[Exclusive]](https://image.ytn.co.kr/general/jpg/2024/1115/202411151506333754_h.jpg)

![[Stars and health] Ok Taek-yeon, Kim Jong-guk, and muscular stars also have herniated disc?](https://image.ytn.co.kr/general/jpg/2024/1115/202411151502035979_h.jpg)

![[G-Star 2024] Pearl Abyss waits 3 hours for new Red Desert demonstration...](https://image.ytn.co.kr/general/jpg/2024/1115/202411151543478905_h.jpg)

![[G-Star 2024] Krafton offers new experiences and opportunities to participate in events at the booth.](https://image.ytn.co.kr/general/jpg/2024/1115/202411151351258230_h.jpg)

![[2024 G-Star] Nexon catches the attention of users with four new products.](https://image.ytn.co.kr/general/jpg/2024/1115/202411151145188909_h.jpg)