"Supercar, luxury house" with tax siphoned off...Tax audits of 37 companies' owners' families

Tax authorities have pulled out knives to target companies and owner families who bought high-priced sports cars and luxury houses in the name of the corporation or evaded gift taxes by "driving all the work" to their children.

The IRS said it has launched a tax investigation into 37 local companies and their owners' families, who are accused of avoiding fair taxes while monopolizing corporate profits due to private-interest-seeking management and moral hazard.

There are 14 companies that privately used company money to buy high-priced real estate and art, 16 companies to give work, and 7 companies that made unfair profits from undisclosed company information.

There have also been cases of stealing the settlement money of platform workers, building a private villa with company money, and disguising it as a training center.

The National Tax Service said it plans to thoroughly verify the private interests of the owner family that undermined the economic stability of people's livelihoods and undermined the value of fairness, and if it is found to have evaded taxes, it will switch to a criminal investigation under the Tax Offender Penalty Act without exception and file a complaint with the prosecution.

※ 'Your report becomes news'

[Kakao Talk] YTN Search and Add Channel

[Phone] 02-398-8585

[Mail] social@ytn.co.kr

The IRS said it has launched a tax investigation into 37 local companies and their owners' families, who are accused of avoiding fair taxes while monopolizing corporate profits due to private-interest-seeking management and moral hazard.

There are 14 companies that privately used company money to buy high-priced real estate and art, 16 companies to give work, and 7 companies that made unfair profits from undisclosed company information.

There have also been cases of stealing the settlement money of platform workers, building a private villa with company money, and disguising it as a training center.

The National Tax Service said it plans to thoroughly verify the private interests of the owner family that undermined the economic stability of people's livelihoods and undermined the value of fairness, and if it is found to have evaded taxes, it will switch to a criminal investigation under the Tax Offender Penalty Act without exception and file a complaint with the prosecution.

※ 'Your report becomes news'

[Kakao Talk] YTN Search and Add Channel

[Phone] 02-398-8585

[Mail] social@ytn.co.kr

[Copyright holder (c) YTN Unauthorized reproduction, redistribution and use of AI data prohibited]

Editor's Recomended News

-

The Central District Prosecutors' Office's collective statement...Attorney General "Impeach Me"

-

Let's go for the first new city reconstruction! Announcement of 360,000 units of the Leading District

-

"My mother took dental prescription medicine and had a general attack"...Son claims 'medical accident'

The Lastest News

-

재생

"Chaotic" on my way home from work due to heavy snow...Emergency for more and more public transportation and snow removal

"Chaotic" on my way home from work due to heavy snow...Emergency for more and more public transportation and snow removal -

Lebanon ceasefire implemented... to "strengthen troops to 10,000 in the south"

Lebanon ceasefire implemented... to "strengthen troops to 10,000 in the south" -

Gyeonggi-do Provincial Government to provide soundproofing facilities to 46 households affected by loudspeakers in South Korea.

-

The front line of Yangpyeong-gun, Gyeonggi-do..."The snow-covered trees touch you".

Entertainment

Game

-

Netmarble will officially release its new RPG 'King Arthur: Legend Rise' on the 27th.

-

Game Culture Foundation verifies the effectiveness of the game and immersion youth healing program...scheduled to be distributed nationwide early next year

-

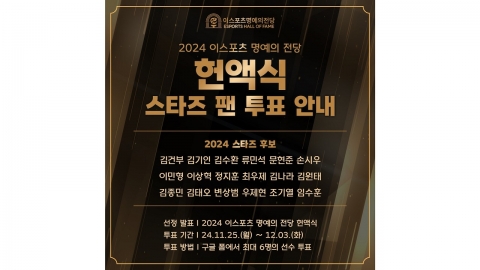

Who is your star? 2024 E-Sports Hall of Fame induction ceremony fan voting begins

![[Focus Y] Can the](https://image.ytn.co.kr/general/jpg/2024/1127/202411271804218526_h.jpg)

![[On site Y]](https://image.ytn.co.kr/general/jpg/2024/1127/202411271729128587_h.jpg)