BOK to announce key rate tomorrow...Interest in the Downward Growth Rate

The Bank of Korea will hold its last Monetary Policy Committee meeting tomorrow (28th) to decide the benchmark interest rate.

The interest rate was cut once last month and is currently 3.25% per annum.

Considering only the domestic situation, there is a possibility of a reduction this month.

Consumer price growth stabilizes to 1% range for second straight month,

This is because

household debt and soaring housing prices have also declined.

In particular, the slowdown in export growth amid a slow recovery in domestic demand and the darkening economic outlook are also bolstering the cut.

However, instability in the won-dollar exchange rate, which goes around 1,400 won, has emerged as a big variable.

In addition, the U.S. Federal Reserve's suggestion of a rate cut is also burdensome to the Bank of Korea.

Although the outlook for a rate freeze is dominant due to these external variables, there may be room for a cut if the growth forecast for next year falls below the 1% range.

There is no disagreement that the economic growth rate makes the forecast announced in August.

The previous forecast, which was 2.4% this year and 2.1% next year, is expected to be lowered to around 2.2% and 2%, respectively.

※ 'Your report becomes news'

[Kakao Talk] YTN Search and Add Channel

[Phone] 02-398-8585

[Mail] social@ytn.co.kr

The interest rate was cut once last month and is currently 3.25% per annum.

Considering only the domestic situation, there is a possibility of a reduction this month.

Consumer price growth stabilizes to 1% range for second straight month,

This is because

household debt and soaring housing prices have also declined.

In particular, the slowdown in export growth amid a slow recovery in domestic demand and the darkening economic outlook are also bolstering the cut.

However, instability in the won-dollar exchange rate, which goes around 1,400 won, has emerged as a big variable.

In addition, the U.S. Federal Reserve's suggestion of a rate cut is also burdensome to the Bank of Korea.

Although the outlook for a rate freeze is dominant due to these external variables, there may be room for a cut if the growth forecast for next year falls below the 1% range.

There is no disagreement that the economic growth rate makes the forecast announced in August.

The previous forecast, which was 2.4% this year and 2.1% next year, is expected to be lowered to around 2.2% and 2%, respectively.

※ 'Your report becomes news'

[Kakao Talk] YTN Search and Add Channel

[Phone] 02-398-8585

[Mail] social@ytn.co.kr

[Copyright holder (c) YTN Unauthorized reproduction, redistribution and use of AI data prohibited]

Editor's Recomended News

-

"My mother took dental prescription medicine and had a general attack"...Son claims 'medical accident'

-

I stabbed him with a knife, saying the tattoo gang was killing him..."It's not a murder attempt".

-

Atonement by making a 'house owner' with a kidnapped dog...Controversy over the beautification of KBS butchers

The Lastest News

-

재생

Yonsei University's 'Controversy over the leak of essay' additional examination on the 8th of next month... "The maximum number of successful applicants is doubled."

Yonsei University's 'Controversy over the leak of essay' additional examination on the 8th of next month... "The maximum number of successful applicants is doubled." -

The second perpetrator of the "Busan Spin Kick" victim was sentenced to prison for a man.

-

재생

The Central District Prosecutors' Office's collective statement...Attorney General "Impeach Me"

The Central District Prosecutors' Office's collective statement...Attorney General "Impeach Me" -

재생

I said I'd like to cooperate, but..."How far are you going to investigate Myung Taekyun?" I'm so nervous.

I said I'd like to cooperate, but..."How far are you going to investigate Myung Taekyun?" I'm so nervous.

Entertainment

Game

-

Netmarble will officially release its new RPG 'King Arthur: Legend Rise' on the 27th.

-

Game Culture Foundation verifies the effectiveness of the game and immersion youth healing program...scheduled to be distributed nationwide early next year

-

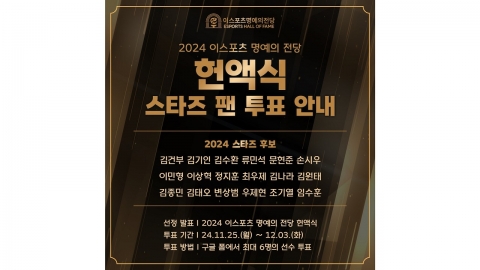

Who is your star? 2024 E-Sports Hall of Fame induction ceremony fan voting begins

![[Focus Y] Can the](https://image.ytn.co.kr/general/jpg/2024/1127/202411271804218526_h.jpg)

![[On site Y]](https://image.ytn.co.kr/general/jpg/2024/1127/202411271729128587_h.jpg)