"Economic stimulus is more urgent"...BOK slashes rate to 3.0 percent

BOK cuts key rate to 3.25 → 3.0% in defiance of market expectations

"Increased downward pressure on growth behind rate cut"

Lee Chang-yong said, "Uncertainty in the trade environment grows after Trump's election"

Bank of Korea's Economic Growth Outlook...2.2% this year, 1.9% next year.

"Increased downward pressure on growth behind rate cut"

Lee Chang-yong said, "Uncertainty in the trade environment grows after Trump's election"

Bank of Korea's Economic Growth Outlook...2.2% this year, 1.9% next year.

[Anchor]

The Bank of Korea's Monetary Policy Committee has cut its key interest rate to 3.0 percent from 3.25% this year.

There were many expectations of a freeze due to currency instability, but I saw that economic stimulus was more urgent than exchange rates.

I'll connect you with reporters for more information. Reporter Ryu Hwan Hong!

Can you tell us the background of the Bank of Korea's Monetary Policy Committee's surprise cut?

[Reporter]

Yes, the Bank of Korea's Monetary Policy Board cut its key interest rate from 3.5% to 3.25% last month, followed by another 3.0% cut.

This further widened the gap between South Korea and the U.S. policy rates from 1.5% to 1.75%.

The central bank said the main reason for the rate cut was the increased downward pressure on growth in the direction of monetary policy.

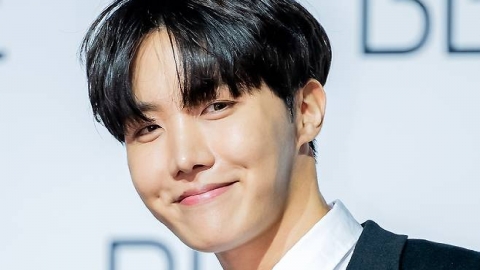

Let's listen to Bank of Korea Governor Lee Chang-yong.

[Lee Chang-yong / Governor of the Bank of Korea: Exchange rate volatility has increased, but downward pressure on growth has increased amid steady inflation and a slowdown in household debt growth. As a result, the Monetary Policy Committee today decided it was appropriate to mitigate downside risks to growth by further cutting the benchmark interest rate.]

Lee said it was a tougher decision than ever, referring to the uncertainty in the trade environment that has grown since former U.S. President Trump's victory in the presidential election.

The Bank of Korea announced its forecast for a revised economic growth rate this year and next year shortly after its decision to cut interest rates.

This year's economic growth forecast was 2.2% from the previous 2.4%, and next year's forecast was lowered from 2.1% to 1.9%.

With growth expected to be 1.9% next year, we decided that we need to preemptively lower interest rates.

The problem is the exchange rate.

This is because former U.S. President Trump's presidential election victory has continued to rise, exceeding KRW 1,400 from KRW to USD.

The central bank said it will manage the exchange rate volatility with the government through various market stabilization measures.

I'm YTN's Ryu Hwan Hong.

※ 'Your report becomes news'

[Kakao Talk] YTN Search and Add Channel

[Phone] 02-398-8585

[Mail] social@ytn.co.kr

The Bank of Korea's Monetary Policy Committee has cut its key interest rate to 3.0 percent from 3.25% this year.

There were many expectations of a freeze due to currency instability, but I saw that economic stimulus was more urgent than exchange rates.

I'll connect you with reporters for more information. Reporter Ryu Hwan Hong!

Can you tell us the background of the Bank of Korea's Monetary Policy Committee's surprise cut?

[Reporter]

Yes, the Bank of Korea's Monetary Policy Board cut its key interest rate from 3.5% to 3.25% last month, followed by another 3.0% cut.

This further widened the gap between South Korea and the U.S. policy rates from 1.5% to 1.75%.

The central bank said the main reason for the rate cut was the increased downward pressure on growth in the direction of monetary policy.

Let's listen to Bank of Korea Governor Lee Chang-yong.

[Lee Chang-yong / Governor of the Bank of Korea: Exchange rate volatility has increased, but downward pressure on growth has increased amid steady inflation and a slowdown in household debt growth. As a result, the Monetary Policy Committee today decided it was appropriate to mitigate downside risks to growth by further cutting the benchmark interest rate.]

Lee said it was a tougher decision than ever, referring to the uncertainty in the trade environment that has grown since former U.S. President Trump's victory in the presidential election.

The Bank of Korea announced its forecast for a revised economic growth rate this year and next year shortly after its decision to cut interest rates.

This year's economic growth forecast was 2.2% from the previous 2.4%, and next year's forecast was lowered from 2.1% to 1.9%.

With growth expected to be 1.9% next year, we decided that we need to preemptively lower interest rates.

The problem is the exchange rate.

This is because former U.S. President Trump's presidential election victory has continued to rise, exceeding KRW 1,400 from KRW to USD.

The central bank said it will manage the exchange rate volatility with the government through various market stabilization measures.

I'm YTN's Ryu Hwan Hong.

※ 'Your report becomes news'

[Kakao Talk] YTN Search and Add Channel

[Phone] 02-398-8585

[Mail] social@ytn.co.kr

[Copyright holder (c) YTN Unauthorized reproduction, redistribution and use of AI data prohibited]

Editor's Recomended News

The Lastest News

-

![[Breaking News] Newzins members hold an emergency press conference on exclusive contracts this evening.](https://image.ytn.co.kr/general/jpg/2024/1128/202411281839227988_h.jpg) [Breaking News] Newzins members hold an emergency press conference on exclusive contracts this evening.

[Breaking News] Newzins members hold an emergency press conference on exclusive contracts this evening. -

Kim Jang-gyeom said, "Until when will you leave Namuwiki alone?""You need to apply domestic law"

-

National Assembly Agrees To ratify Korea-U.S. Defense Cost Sharing Agreement Between 2026 and 2030

-

National Assembly passes the amendment to the Science and Technology Support Act to strengthen the development of scientific talent.