미국 일자리 전월 대비 5만 명 증가…전망치 밑돌아

지난해 1분기 일자리 11.1만 개…6∼8월엔 1.1만 개

"고용, 나쁘지 않아…금리 인하 서두르지 않을 듯"

연준, 대출·소비·채용 촉진 위해 금리 3차례 인하

-

특검, 윤석열 구형 불발…오는 13일로 결심 연기재생

- 지귀연 "프로는 징징대지 않는다"…변호인에 ’경고’

- 군경이 아니라 시민이 폭동?…’억지 주장’ 쏟아낸 변호인단

- 윤석열, 검은 정장입고 재판부에 ’꾸벅’…조는 듯한 모습도

-

[날씨] 주말 강원, 휴일 서해안…최고 20㎝ ’대설’ 뒤 강력 한파재생

![[날씨] 주말 강원, 휴일 서해안…최고 20㎝ ’대설’ 뒤 강력 한파](https://image.ytn.co.kr/general/jpg/2026/0110/202601100005524294_h.jpg)

-

주말과 휴일, 전국에 많은 눈이 내리고 뒤이어 매서운 한파가 찾아옵니다. 오늘은 강원도에, 내일은 서해안에 폭설이 예고돼 교통안전에 비상이 걸렸습니다. 김진두 기자가 보도합니다. [기자] 눈은 중북부 지방부터 시작돼 주말에는 전국으로 확산하겠습니다. 가장 많은 눈이 예상되는 지역은 강원도. 철원 등 강원 북부내륙과 산간에는 15㎝가 넘는 대설이 쏟아지겠고, 그 밖의 지역에도 3~10㎝의 눈이 오겠습니다. 경기 동부 3~8㎝, 서울 1∼3㎝, 경상권에도 1~5㎝의 눈이 예상됩니다. 충청과 호남은 눈이 휴일까지 이어지겠습니다. 충남 서해안에 5~10㎝, 전라 서해안에는 최고 20㎝, 대설경보 급의 큰 눈이 올 것으로 보입니다. [공상민 / 기상청 예보분석관 : 기온이 낮은 중부 내륙 중심에는 10일(주말), 그리고 전라권에는 11일(휴일)에 매우 강하고 많은 눈이 내릴 것으로 예상됩니다.] 잠시 주춤하던 한파는 휴일 다시 기승을 부리겠습니다. 서울 아침 기온이 영하 8도, 낮 기온도 영하 4도에 머물 전망입니다. 잠시 해제됐던 한파특보가 다시 내려지는 곳이 많겠습니다. 기상청은 이번 한파가 다음 주 중반까지 이어질 것으로 전망하고 도로 살얼음과 동파 사고 등에 주의를 당부했습니다. YTN 김진두입니다. ※ ’당신의 제보가 뉴스가 됩니다’ [카카오톡] YTN 검색해 채널 추가 [전화] 02-398-8585 [메일] social@ytn.co.kr

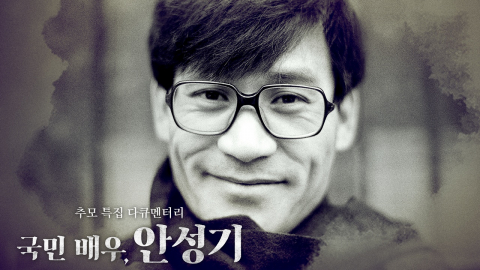

![[Y현장] "작품 속에 살아있을 이름"…'국민 배우' 안성기, 하늘의 별이 되다(종합)](https://image.ytn.co.kr/general/jpg/2026/0109/202601091042149519_h.jpg)

![[Y터뷰] '프로젝트 Y' 전종서 "한소희가 DM 보내 처음 알게 돼…답장했다"](https://image.ytn.co.kr/general/jpg/2026/0109/202601091441089698_h.jpg)

![[Y현장] 정우성, 고 안성기 추도사 "한국영화 온 마음으로 품은 선배님…영면하시길"](https://image.ytn.co.kr/general/jpg/2026/0109/202601091008157730_h.jpg)