-

'강선우 1억 의혹' 김경, 곧 귀국…오늘 조사 가능성재생

- 민주당 오늘 신임 원내대표·최고위원 3인 선출

- 개혁신당, 야 3당 연석회담 제안…"특검법 논의"

- 경찰, ’성추행 의혹’ 장경태 비공개 조사…고소 44일 만 [앵커리포트]

-

특검, 모레 윤석열 구형….윤도 ’침대 변론’ 이어가나재생

- 윤, 곧 법정공방 2라운드…오는 16일 ’체포방해’ 선고

- ’역대급’ 3특검이 남긴 흔적…2백억 지출·장기미제 증가

- 김건희, 금품 받고 "도울 거 없나"…청탁 창구 ’V0’

-

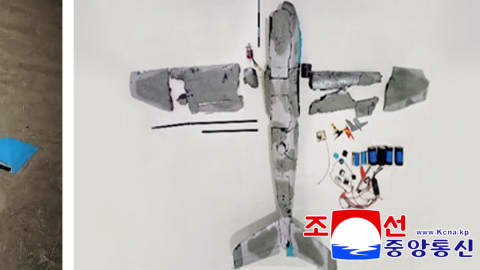

북 김여정 "무인기 설명해야"…청 "진상규명·신속 공개"재생

-

국방부가 북한이 격추했다고 주장한 무인기를 운용하지 않았다고 밝히자, 북한 김여정 노동당 부부장은 도발 책임에서 벗어날 수 없다며 구체적인 설명을 요구했습니다. 청와대 안보실은 진상을 규명해 결과를 신속하게 공개하겠다면서, 정부는 남북 간 신뢰를 쌓아가기 위한 노력을 지속해 갈 것이라고 거듭 강조했습니다. 취재기자 연결해 자세한 소식 살펴봅니다. 김문경 기자! 김여정 부부장의 담화 내용 전해 주시죠. [기자] 네. 김여정 북한 노동당 부부장이 오늘 담화에서 설사 민간단체나 개인 소행이라도 국가안보를 책임지는 당국은 그 책임에서 벗어날 수는 없다고 주장했습니다. 우리 국방부가 북한이 주장한 날짜에 무인기를 운용한 적이 없다고 반박한 것에 대한 담화를 발표한 겁니다. 김여정 부부장은 이어 민간의 소행이어서 주권침해가 아니라는 논리를 시도한다면 아마 북한에서 민간단체들이 날리는 수많은 비행물체들의 출현을 목격하게 될 것이라고 말했습니다. 그러면서 한국 국방부가 북한을 도발하거나 자극할 의도가 없다고 밝힌 것에 대해서는 그나마 현명한 선택이라고 덧붙였습니다. 특히 사태의 본질은 한국발 무인기가 영공을 침범한 것이라며 이에 대한 구체적인 설명이 반드시 있어야 한다고 강조했습니다. 북한은 어제 인민군 총참모부 성명을 통해 반드시 대가를 치르게 될 거라고 위협했는데, 오늘은 무인기에 대한 설명을 요구한 점이 눈에 띕니다. 다만 한국은 주권침해 도발에 대한 책임에서 절대로 벗어날 수 없고, 대가에 대해 심중히 고민해야 할 것이라고도 말했는데요. 북한 주민들이 보는 노동신문에도 이를 공개하면서 주민들을 결속하기 위한 수단으로 삼겠다는 의도와 함께 남남갈등을 유도하고 적대적 두 국가 규정을 공고히 하려는 다목적 포석이 깔렸다는 분석이 나옵니다. [앵커] 청와대 안보실도 이번 무인기 사건에 대한 입장을 내놨다고요. [기자] 네, 청와대 안보실은 북측에 대한 도발이나 자극할 의도가 없다는 점을 다시 한 번 확인한다며, 군경합동조사를 통해 진상을 규명하고, 결과를 신속하게 공개하겠다고 밝혔습니다. 그러면서 정부는 남북 간 긴장을 완화하고 신뢰를 쌓아가기 위한 실질적인 조치와 노력을 지속해 갈 것이라고 거듭 강조했습니다. 이 대통령이 지시해 구성되는 군경 합동수사는 북한의 주장을 확인하기 위해 누가 날렸는지에 집중할 거로 보입니다. 북한이 주장한 지난해 9월 무인기 동선 시간을 보면 경기도 파주시 적성면 일대에서 출발한 무인기의 이륙 시점은 오전 11시 15분이었고, 오후 2시 25분쯤 격추됐습니다. 모두 낮 시간대에 이뤄졌고 장소까지 특정됐지만, 시간이 오래 지난 만큼 기록을 확보하느냐가 관건이 될 거로 보입니다. 또 지난 4일 강화도 송해면 일대에서 출발했다는 무인기 역시 마찬가지인데, 두 대 모두 비슷한 크기와 형상이어서 우리가 날렸다면 같은 인물이나 단체가 날린 게 아니냐는 분석이 나옵니다. 지금까지 정치부에서 YTN 김문경입니다. ※ ’당신의 제보가 뉴스가 됩니다’ [카카오톡] YTN 검색해 채널 추가 [전화] 02-398-8585 [메일] social@ytn.co.kr

실시간 이슈

에디터 추천뉴스

-

재생

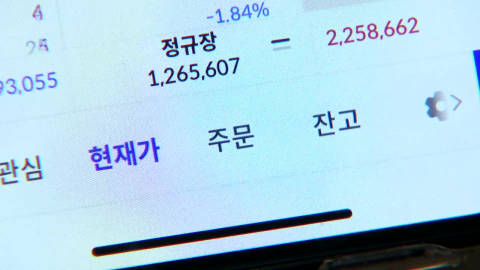

"빚내서 산다" 삼성전자 빚투 2조 원…’역대 최고’

"빚내서 산다" 삼성전자 빚투 2조 원…’역대 최고’ -

재생

’엔비디아 GPU’ 26만 장 확보했지만…전력은?

’엔비디아 GPU’ 26만 장 확보했지만…전력은? -

재생

미군 ’아파치 감축’ 가시화…우리 군도 고심

미군 ’아파치 감축’ 가시화…우리 군도 고심 -

재생

’블랙아이스 참변’ 상주 고속도로…경찰, 블랙박스 전수 분석

’블랙아이스 참변’ 상주 고속도로…경찰, 블랙박스 전수 분석 -

재생

![미국 시민권 포기하고 입대한 '이재용 장남' 이지호…해군 통역장교 복무 [지금이뉴스]](https://image.ytn.co.kr/general/jpg/2026/0111/202601111257339675_h.jpg) 미국 시민권 포기하고 입대한 '이재용 장남' 이지호…해군 통역장교 복무 [지금이뉴스]

미국 시민권 포기하고 입대한 '이재용 장남' 이지호…해군 통역장교 복무 [지금이뉴스] -

재생

경북 의성 산불 18시간 만에 꺼져…건조·강풍에 산불 ’비상’

경북 의성 산불 18시간 만에 꺼져…건조·강풍에 산불 ’비상’ -

재생

"미국인도 덴마크인도 되고 싶지 않아"

"미국인도 덴마크인도 되고 싶지 않아" -

재생

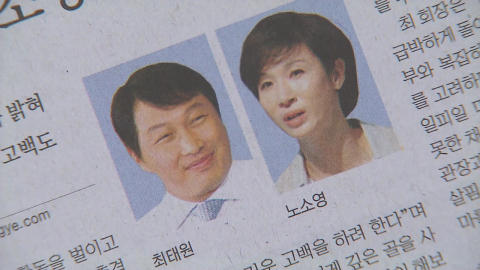

"최태원·노소영 파기 환송심 신속 결론"…쟁점은?

"최태원·노소영 파기 환송심 신속 결론"…쟁점은? -

재생

"탈팡족을 선점하라"…플랫폼 본격 경쟁시대 ’개막’

"탈팡족을 선점하라"…플랫폼 본격 경쟁시대 ’개막’ -

재생

쿠팡, ’근무일지 조작’ 정황…CCTV 선별 의혹도

쿠팡, ’근무일지 조작’ 정황…CCTV 선별 의혹도 -

재생

"한국 연예인처럼"…K-뷰티테크·헬스케어로 CES ’들썩’

"한국 연예인처럼"…K-뷰티테크·헬스케어로 CES ’들썩’ -

재생

![트럼프 ’이름 박기’에 55년 인연 오페라단도 ’결별’ [앵커리포트]](https://image.ytn.co.kr/general/jpg/2026/0111/202601110918551477_h.jpg) 트럼프 ’이름 박기’에 55년 인연 오페라단도 ’결별’ [앵커리포트]

트럼프 ’이름 박기’에 55년 인연 오페라단도 ’결별’ [앵커리포트]

많이 본 뉴스

- 1 미군 ’아파치 감축’ 가시화...우리 군도 고심

- 2 국토부, 이혜훈 ’부정당첨’ 의혹 사실확인 착수...왜 못 걸렀나?

- 3 [자막뉴스] 국방부 발표에 맞받아친 김여정..."남한, 책임 못 벗어나"

- 4 [자막뉴스] "토네이도처럼 강풍 엄청났다"...간판 추락해 20대 참변

- 5 "상처 받았다"...'대상' 유재석 손에 들린 꽃다발에 업계 뿔난 이유 [지금이뉴스]

- 6 미국 시민권 포기하고 입대한 '이재용 장남' 이지호...해군 통역장교 복무 [지금이뉴스]

- 7 [자막뉴스] "중학교 때 배운 것 떠올려서"...어르신 구해낸 용감한 고교생들

- 8 북 김여정 "무인기 설명해야"...청 "진상규명·신속 공개"

- 9 ’강선우 1억 의혹’ 김경, 곧 귀국...오늘 조사 가능성

- 10 전남 20㎝ 넘는 폭설 ’도로·바닷길’ 통제...피해 속출

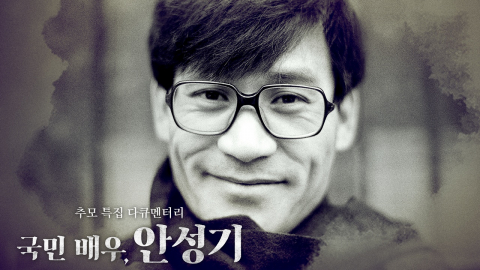

![[Y현장] "작품 속에 살아있을 이름"…'국민 배우' 안성기, 하늘의 별이 되다(종합)](https://image.ytn.co.kr/general/jpg/2026/0109/202601091042149519_h.jpg)

![[Y터뷰] '프로젝트 Y' 전종서 "한소희가 DM 보내 처음 알게 돼…답장했다"](https://image.ytn.co.kr/general/jpg/2026/0109/202601091441089698_h.jpg)

![[Y현장] 정우성, 고 안성기 추도사 "한국영화 온 마음으로 품은 선배님…영면하시길"](https://image.ytn.co.kr/general/jpg/2026/0109/202601091008157730_h.jpg)