-

특검, 윤석열 사형 구형…"전두환보다 엄정히 단죄해야"재생

- 청와대 "국민 눈높이 부합해 판결할 것"…국민의힘은 ’침묵’

- [속보] 내란 특검, 윤석열 전 대통령에 사형 구형

- ’작전 성공’ 자화자찬하더니…’침대 재판’도 특검 탓

-

단독 경찰, 김병기 아파트 CCTV 확보 시도…’같은 라인’ 구의원 조사?재생

- "탈당은 사형선고" 버티는 김병기…당심은 ’싸늘’

- 손잡은 장동혁-이준석…’특검 연대’ 공동전선 본격화

- ’1억 의혹’ 강선우 통신영장…김경 조만간 재소환

-

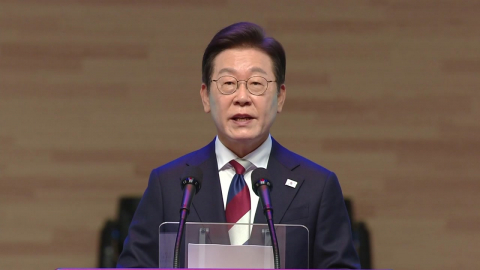

’중일 갈등’에 거리 두며…"한중일 3국 소통 강조"재생

-

’중일 갈등’이 고조되는 상황에서 열린 이번 한일 정상회담에서 이재명 대통령은, 한중일 3국의 소통과 협력을 강조했습니다. 두 나라 문제에 직접 개입하지 않고 거리를 두며, 중재 의지를 내비친 거란 해석이 나옵니다. 강진원 기자의 보도입니다. [기자] 다카이치 일본 총리의 ’타이완 유사시 개입 시사’ 발언 이후 중일 관계가 악화일로로 치닫는 가운데 일본을 찾은 이재명 대통령. 역내 평화와 안정 문제를 언급하며, 중국과 일본을 동시에 거론했습니다. [이재명 / 대통령 : 저는 동북아 지역 한중일 3국이 최대한 공통점을 찾아 함께 소통하며 협력해 나갈 필요가 있다는 점도 강조하였습니다.] 중일 양국, 어느 한쪽의 편을 들지 않고, 원만한 문제 해결을 바란다는 뜻을 거듭 내비친 겁니다. 중국의 대일본 희토류 수출 통제 등 민감한 세부 현안 관련 의견은 공개석상에선 밝히지 않았는데, 중국을 자극하지 않으려는 의도로 풀이됩니다. 수위 조절을 하긴 했지만, 공급망 문제를 꺼내 든 다카이치 총리와 미묘한 온도 차가 엿보입니다. [다카이치 사나에 / 일본 총리 : 이재명 대통령님과는 공급망 협력에 대해서 깊은 논의를 했습니다.] 다카이치 총리는 특히, 한일, 한미일 간 안보 협력과 전략적 공조의 중요성만 강조했을 뿐, 중국은 언급조차 하지 않았습니다. 이처럼 갈등의 골이 깊어진 중일 두 나라 문제에 이 대통령이 직접 뛰어들기보단, 적당한 거리를 두며 이른바 ’삼각 대화’ 해법을 제시한 거란 분석에 힘이 실리는 이유입니다. 이 대통령은 한반도 평화와 한일 관계 발전을 위한 일본 측의 긍정적인 반응도 끌어냈습니다. 한반도의 완전한 비핵화와 항구적 평화 구축에 대한 양국의 의지를 재확인했고, 대북 정책은 긴밀히 공조하기로 했습니다. 인공지능과 지식재산 보호, 저출생·고령화와 국토 균형성장, 그리고 스캠 등 초국가 범죄 대응 분야에서 협력을 강화하기로 뜻을 모았습니다. 이 대통령은 중일 갈등과 관련해, 당장 우리 정부의 역할은 제한적이란 입장을 밝힌 적이 있습니다. 역설적으로 이는 때가 되면 중재 역할을 할 수도 있다는 의미라, 그 시기와 방법에 관심이 쏠리고 있습니다. 오사카에서 YTN 강진원입니다. 영상기자 : 최영욱, 최광현 영상편집 : 최연호 디자인 : 정민정 ※ ’당신의 제보가 뉴스가 됩니다’ [카카오톡] YTN 검색해 채널 추가 [전화] 02-398-8585 [메일] social@ytn.co.kr

실시간 이슈

에디터 추천뉴스

-

재생

단독 '충격' 귀화 절차 모르고, 부모에게도 비용 청구

단독 '충격' 귀화 절차 모르고, 부모에게도 비용 청구 -

재생

이석연 "이혜훈, 잘못된 인선"…청문회·특검으로 ’정국 안갯속’

이석연 "이혜훈, 잘못된 인선"…청문회·특검으로 ’정국 안갯속’ -

재생

서울 시내버스 파업 첫날…퇴근길 시민들 ’발 동동’

서울 시내버스 파업 첫날…퇴근길 시민들 ’발 동동’ -

재생

![[날씨] 한낮에도 체감 -10℃…"내일 아침 더 춥다"](https://image.ytn.co.kr/general/jpg/2026/0113/202601131805037348_h.jpg) [날씨] 한낮에도 체감 -10℃…"내일 아침 더 춥다"

[날씨] 한낮에도 체감 -10℃…"내일 아침 더 춥다" -

재생

9·19 군사합의 복원 가시화?…"다양한 방안 검토"

9·19 군사합의 복원 가시화?…"다양한 방안 검토" -

재생

로저스 쿠팡 대표, 이미 해외로…경찰 "조사 일정 조율 중"

로저스 쿠팡 대표, 이미 해외로…경찰 "조사 일정 조율 중" -

재생

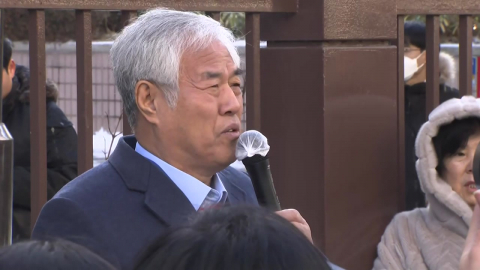

’서부지법 폭동 배후 의혹’ 전광훈 구속…"증거인멸 염려"

’서부지법 폭동 배후 의혹’ 전광훈 구속…"증거인멸 염려" -

재생

’홈플러스 사태’ MBK 김병주 구속 기로…’묵묵부답’

’홈플러스 사태’ MBK 김병주 구속 기로…’묵묵부답’ -

’비계 삼겹살’ 논란 막는다…삼겹살, 앞삼겹·뒷삼겹·돈차돌로 구분

’비계 삼겹살’ 논란 막는다…삼겹살, 앞삼겹·뒷삼겹·돈차돌로 구분 -

재생

’무면허 운전 방조’ 전동킥보드 업체 첫 송치…처벌은 ’미약’

’무면허 운전 방조’ 전동킥보드 업체 첫 송치…처벌은 ’미약’ -

재생

"갱년기 영양제라며?"…루바브 일반식품 기능성분 ’제로’

"갱년기 영양제라며?"…루바브 일반식품 기능성분 ’제로’ -

’그린란드 51번째 주 편입’ 법안 미 하원에서 발의

’그린란드 51번째 주 편입’ 법안 미 하원에서 발의

많이 본 뉴스

- 1 [속보] 내란 특검, 윤석열 전 대통령에 사형 구형

- 2 특검, 윤석열에 사형 구형..."전두환보다 엄정히 단죄해야"

- 3 "6시간 근무, 월 180만 원"...국세청, 체납관리 요원 대거 채용

- 4 [단독] 경찰, 김병기 아파트 CCTV 확보 시도...’같은 라인’ 구의원 조사?

- 5 "李 아들들 군 면제" 글 썼던 이수정...벌금 5백만원 구형

- 6 [속보] ’파업 돌입’ 서울 시내버스 노사 내일 협상 재개

- 7 공군기지 불법촬영 중국인들 측 "철없는 아이들에 관용 부탁"

- 8 "뒤통수에 근접 저격...이란 시위, 6천 명 넘게 숨져"

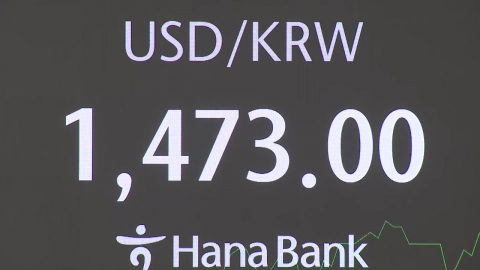

- 9 백약이 무효?...원·달러 환율 다시 1,470원대로

- 10 오세훈 시장, ’서울 시내버스 파업’ 긴급 대책회의

![[Y터뷰] "늘 낭떠러지에 선 기분"…50대 '언더독' 권상우의 목표](https://image.ytn.co.kr/general/jpg/2026/0113/202601131620584468_h.jpg)

![[Y현장] 설레는 케미, 아름다운 영상미…김선호·고윤정의 만남 '이사통'(종합)](https://image.ytn.co.kr/general/jpg/2026/0113/202601131227351419_h.jpg)