-

김건희 오늘 첫 선고…'통일교' 권성동·윤영호도 결론재생

-

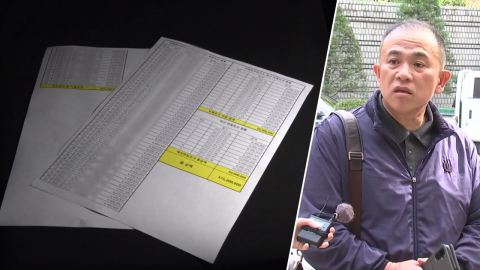

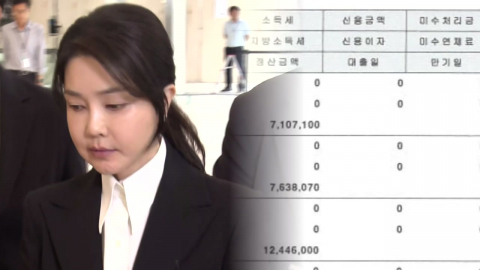

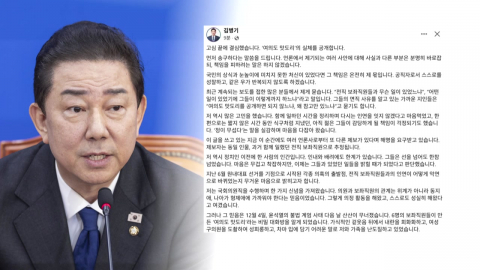

특검이 기소한 김건희 씨의 첫 1심 선고가 오늘(8일) 결정됩니다. 국민의힘 권성동 의원과 윤영호 전 통일교 세계본부장에 대한 1심 선고도 연이어 나옵니다. 임예진 기자가 보도합니다. [기자] 김건희 씨가 전직 영부인으로서 처음으로 법의 심판대에 섭니다. 지난 8월 말, 민중기 특검에 의해 구속 기소된 지 다섯 달 만입니다. 유무죄가 가려질 김 씨의 혐의는 도이치모터스 주가조작과 이른바 ’명태균 게이트’ 그리고 통일교 관련 청탁 의혹까지 세 가지입니다. 특검은 지난달 열린 결심 공판에서 김 씨에게 징역 15년을 구형했습니다. 혐의별로 도이치모터스 주가조작과 통일교 청탁 의혹에 대해선 징역 11년을, 명태균 씨 관련 정치자금법 위반 혐의에 대해선 징역 4년을 내려달라 요청했습니다. 벌금 20억 원과 추징금 9억 4천여만 원도 함께 구형했습니다. 특검 측은 김 씨가 대한민국 법 위에 존재해 왔다면서, 대통령 배우자 지위를 남용해 수사를 회피하며 사법 시스템을 무력화했다고 질타했습니다. 줄곧 진술을 거부해 온 김 씨는 최후진술에 이르자 "자신의 역할과 자격에 비해 잘못한 게 많은 거 같다"며 사과했습니다. 다만, 혐의에 대해선 다툴 여지가 있다고 말했습니다. 김건희 씨 재판을 심리하는 서울중앙지법 형사합의27부는 같은 날 윤영호 전 통일교 세계본부장과 국민의힘 권성동 의원에 대한 선고도 잇달아 진행합니다. 세 사람 모두 ’통일교 정교 유착’ 의혹에 연루됐는데, 특검은 권 의원에 대해선 징역 4년과 추징금 1억 원을, 윤 전 본부장에게는 징역 4년을 구형했습니다. 한학자 총재 등 다른 통일교 관계자들의 재판이 이어지고 있고, 합동수사본부 수사와도 맞닿아 있는 만큼 판결의 파장이 적잖을 거로 보입니다. YTN 임예진입니다. 영상기자 : 최성훈 영상편집 : 고창영 디자인 : 신소정 ※ ’당신의 제보가 뉴스가 됩니다’ [카카오톡] YTN 검색해 채널 추가 [전화] 02-398-8585 [메일] social@ytn.co.kr

-

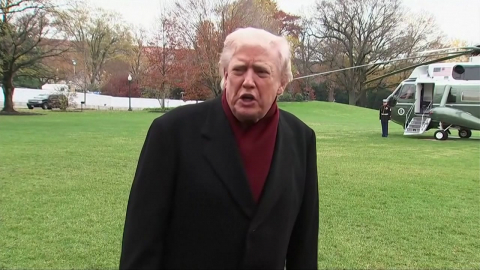

트럼프의 ’몽니’ 이유는?…2주 전 디지털 분야 경고 서한도재생

-

미국, 2주 전 디지털 관련 경고성 서한 보내

미 대법원 상호관세 판결·11월 중간선거도 배경

쿠팡에 대한 대응도 미국 불만 부른 듯

![[날씨] 오늘 더 추워진다…한파특보 확대, 중부 체감 -20℃](https://image.ytn.co.kr/general/jpg/2026/0128/202601280022276347_h.jpg)

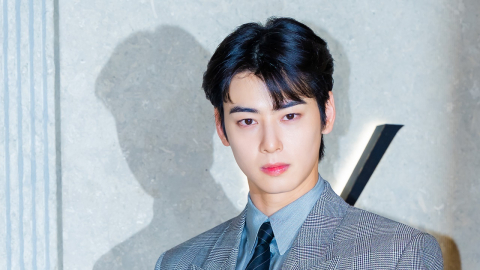

![[Y터뷰] '이사통' 김선호 "고윤정 캐스팅, 기뻤다…성격 정말 좋아"](https://image.ytn.co.kr/general/jpg/2026/0126/202601261110470086_h.jpg)