-

코스피 4,600도 뚫어…'14만 전자·76만 닉스' 기록재생

-

새해 들어 코스피가 매 거래일마다 100포인트 이상 오르면서 새 역사를 쓰고 있습니다. 오늘은 개장 직후 1.6% 이상 급등하며 사상 처음 4,600선을 넘었습니다. 반도체 투톱의 상승세가 뜨거운데요, 삼성전자와 SK하이닉스는 오늘도 최고가를 기록했습니다. 취재기자를 연결해 좀 더 알아보겠습니다. 류환홍 기자, 코스피 상승세가 놀라운데 현재는 얼마나 올라와 있습니까? [기자] 코스피가 4,610선까지도 넘었었는데 지금은 4,570선으로 내려와 숨을 고르고 있습니다. 코스피는 0.9% 오른 4,566으로 출발했는데 6분쯤 지나서 상승폭이 1.6%로 커지며 사상 처음 4,600선을 넘었습니다. 이후 1.7%로 상승폭이 더 커져서 4,611까지 넘겼습니다. 개장 직후 개인이 순매수를 하면서 지수가 올랐는데, 그 이후 개인은 순매도로 돌아섰고 외국인이 순매수를 이어받았습니다. 오늘도 코스피 상승의 주역은 반도체 투톱이었습니다. 삼성전자는 4% 가까이 올라 144,000원대에 첫 진입을 해서 '14만 전자' 기록을 세웠습니다. SK하이닉스는 5% 가까이 오른 762,000원대에 처음 오르며 '76만 닉스' 기록을 달성했습니다. 간밤 뉴욕증시에서 다우와 S&P500 지수가 사상 최고치로 마감했고 메모리 반도체 업체인 마이크론이 10% 이상 급등한 영향으로 보입니다. 반도체 투톱이 연일 최고가를 경신하면서 증권사 중에는 '18만 전자'와 '95만 닉스'까지 목표가를 제시하는 곳이 나오고 있습니다. 미국 IT·가전 전시회, CES에서 휴머노이드 로봇을 선보여 관심을 끈 현대차가 7% 급등하는 등 현대모비스, 현대글로비스 등 현대차그룹주도 강세입니다. 코스닥은 0.2% 오른 957로 출발했지만 곧장 하락세로 접어들어 1.2%까지 하락폭이 깊어졌습니다. 개인 홀로 순매수를 하고 있지만 외국인과 기관은 순매도를 하고 있습니다. 원-달러 환율은 1,448원으로 출발해 1,449원까지 오르는 등 1,440원대 후반에서 움직이고 있습니다. 베네수엘라 사태 이후 원-달러 환율은 1,440원대 후반으로 올라온 상태입니다. 지금까지 YTN 류환홍입니다. ※ '당신의 제보가 뉴스가 됩니다' [카카오톡] YTN 검색해 채널 추가 [전화] 02-398-8585 [메일] social@ytn.co.kr

-

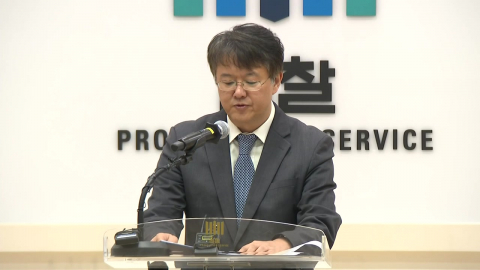

[현장영상+] 장동혁 "12월 3일 비상계엄, 잘못된 수단…국민께 사과"재생

![[현장영상+] 장동혁 "12월 3일 비상계엄, 잘못된 수단…국민께 사과"](https://image.ytn.co.kr/general/jpg/2026/0107/202601071021158725_h.jpg)

- 강선우 전 사무국장 "1억 받은 적 없다" 혐의 부인…주장 엇갈려

- [현장영상+] 구윤철 "정부의 노력만으론 한계…함께 합심해야"

- 극우 유튜버 고성국, 국민의힘 입당…장동혁 '쇄신안' 초읽기 [앵커리포트]

실시간 이슈

에디터 추천뉴스

-

재생

'정교유착' 합수본 본격 수사 준비…본부장 내일 출근

'정교유착' 합수본 본격 수사 준비…본부장 내일 출근 -

재생

![[날씨] 내일 다시 반짝 강추위, 서울 -9℃…중부·경북 한파주의보](https://image.ytn.co.kr/general/jpg/2026/0107/202601071048291512_h.jpg) [날씨] 내일 다시 반짝 강추위, 서울 -9℃…중부·경북 한파주의보

[날씨] 내일 다시 반짝 강추위, 서울 -9℃…중부·경북 한파주의보 -

재생

'혁신가들의 등장' 막 오른 CES 2026…빛나는 한국 기업들

'혁신가들의 등장' 막 오른 CES 2026…빛나는 한국 기업들 -

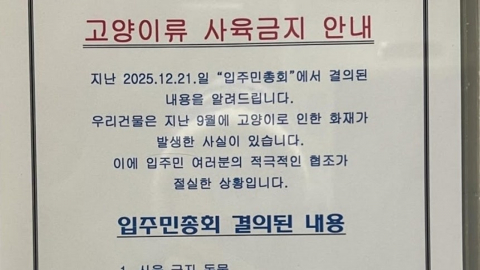

"고양이 키우면 이사해라"…인천 오피스텔 공지 논란

"고양이 키우면 이사해라"…인천 오피스텔 공지 논란 -

"맨손으로 끌어내"…스위스 술집 화재서 청년 10명 구한 영웅

"맨손으로 끌어내"…스위스 술집 화재서 청년 10명 구한 영웅 -

"다윗왕도 여자 많았다"며 여신도들 성착취…50대 전직 목사 구속

"다윗왕도 여자 많았다"며 여신도들 성착취…50대 전직 목사 구속 -

카카오에서 성추행한 개발자, 토스 이직 3일만에 퇴사 조치

카카오에서 성추행한 개발자, 토스 이직 3일만에 퇴사 조치 -

재생

!["김정은·주애 과도한 스킨십"…일 매체 '이례적' 지적 [앵커리포트]](https://image.ytn.co.kr/general/jpg/2026/0107/202601070915049310_h.jpg) "김정은·주애 과도한 스킨십"…일 매체 '이례적' 지적 [앵커리포트]

"김정은·주애 과도한 스킨십"…일 매체 '이례적' 지적 [앵커리포트] -

뉴욕 유가 2% 급락…베네수엘라 급습 이후 ’엎치락뒤치락’

뉴욕 유가 2% 급락…베네수엘라 급습 이후 ’엎치락뒤치락’ -

재생

"우리의 반구" 서반구 장악 의지 노골화…미 의회, 제동 거나

"우리의 반구" 서반구 장악 의지 노골화…미 의회, 제동 거나 -

미국인들 "물가·의료·정부 부패가 중대한 문제"

미국인들 "물가·의료·정부 부패가 중대한 문제" -

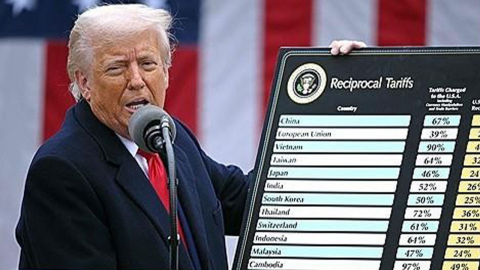

"상호관세 패소하면 트럼프 행정부 200조 돌려줘야"

"상호관세 패소하면 트럼프 행정부 200조 돌려줘야"

많이 본 뉴스

- 1 [속보] 서울 등 중부·경북 내륙 한파주의보...밤사이 10℃ 하강

- 2 [속보] 국민의힘 장동혁 "12월 3일 비상계엄, 잘못된 수단...국민께 사과"

- 3 [현장영상+] 장동혁 "12월 3일 비상계엄, 잘못된 수단...국민께 사과"

- 4 "고양이 키우면 이사해라"...인천 오피스텔 공지 논란

- 5 "맨손으로 끌어내"…스위스 술집 화재서 청년 10명 구한 영웅

- 6 [속보] 삼성전자·SK하이닉스 나란히 사상 최고가 경신

- 7 "김정은·주애 과도한 스킨십"...일 매체 '이례적' 지적 [앵커리포트]

- 8 트럼프 "가장 강력한 군대 증명..."중간선거 지면 탄핵소추 당할 것

- 9 말 바꿨던 통일교 윤영호, ’금품 제공’ 인정

- 10 '혁신가들의 등장' 막 오른 CES 2026...빛나는 한국 기업들

![[Y현장] 황신혜 "데뷔작서 호흡한 안성기 선배님, 일찍 떠나 아쉬워" 눈물](https://image.ytn.co.kr/general/jpg/2026/0106/202601061140068550_h.jpg)